what are the irmaa brackets for 2022gregorio leon wife

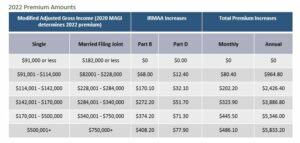

The traces drawn for every bracket could cause a sudden leap within the premiums you pay. IR-2022-182, October 18, 2022 The Internal Revenue Service today announced the tax year 2023 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes. Fresh blogs, financial reminders, and upcoming events delivered to your inbox monthly. 23 0 obj

<>

endobj

What little Ive read suggests the thresholds arent guaranteed to go up with inflation or even stay the same one year to the next - they could even go down? So, if your client reports a higher MAGI in 2020, they will face the surcharge once the IRMAA brackets are released. For some new retirees, there's an extra step needed when it comes to signing up for Medicare. The InvestmentNews staff plans to ask policy and financial experts in the coming months about their vision for the future of Social Security in the 21st century. In 2022, the standard monthly premium for Part B is $170.10.Depending on your yearly income, you may have an additional IRMAA surcharge. The top marginal income The premiums paid by Medicare beneficiaries cowl about 25% of this system prices for Half B and Half D. The federal government pays the opposite 75%. Key planning strategies like asset location and Roth conversions can dramatically reduce the taxes you pay throughout retirement and your heirs tax liability. AGENTS, IF YOU NEED A SCOPE OF APPOINTMENT, CLICK THIS LINK. The 2022 Part B total premiums for high-income beneficiaries are below in the 2022 Medicare IRMAA Brackets table. Does making them pay one other $1,600 make that a lot distinction? The federal government calls individuals who obtain Medicarebeneficiaries. For those single filers in the MAGI range of over $91,000 to $114,000, that means your Part B premium is $238.10. The required form has a list of "life-changing" events that qualify as reasons for reducing or eliminating the IRMAAs, including marriage, death of a spouse, divorce, loss of pension or the fact that you stopped working or reduced your hours. Best of all it's totally FREE! Utilizing the revenue from two years in the past makes it a little bit tougher. Income-Related Monthly Adjustment Amount (IRMAA) surcharges that often blindside seniors on Medicare. Am I just missing it? I have been struggling with IRMAA since it was introduced during the Bush Administration. By clicking "Sign me up! you are agreeing to receive emails from MedicareAdvantage.com. KPE. TheMedicare Income-Related Monthly Adjustment Amount (IRMAA) is an amount Medicare beneficiaries pay in addition to your Part B or Part D premium if their income is above a certain level. Each dollar distributed is a dollar of taxable income, which is an unavoidable factor that will trip many into IRMAA surcharges. There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. IRMAA applies to both Part B Medicare and Part D. Not yet announced for 2022. The surcharges are comparatively smaller in {dollars}. In case your revenue two years in the past was greater since you had been working at the moment and now your revenue is considerably decrease since you retired (work discount or work stoppage), youll be able to attraction the IRMAA evaluation. Agents are credited for all enrollments. Medicare imposes surcharges on higher-income beneficiaries. For single individuals, long-term capital gains are taxed at 0% if your 2021 taxable income is below $40,000 ($80,000 if married), 15% if your income is $40,001 to $441,450 ($80,001 to $496,600 if married) and 20% if your income is above $441,450 ($496,600 if married). Plan availability varies by region and state. Readmore, Some 2023 Original Medicare premium rates are lower than in 2022. IRMAA is an additional amount that some people might have to pay along with their Medicare premium if their modified adjusted gross income (MAGI) is higher than a Kiplinger was not compensated in any way. As youre probably aware, the standard premium for Medicare Part B is $170.10 in 2022 and thats just a one-time charge! 63 0 obj

<>stream

Please enter your information to get your free quote. GTL offers plans for many levels. 0

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more! Just like with marketplace or employer coverage, you have to make some decisions to determine the best fit which directly influences the cost (see my refresher to understand the different coverage levels and costs for Medicare).Once thats decided, you also have to be aware that your income throughout retirement will affect the premium. He said JDARNELL its only a marginal change of $XX. Massive deal? The information being provided is strictly as a courtesy/convenience. Give me a museum and I'll fill it. Whats really confusing is that IRMAA is determined based on your income from two years earlier.  Your MAGI is then over $200,000, and two years later you get a notice that your IRMAA caused your Medicare Part B premium to increase from $340.20 a month to $544.50. As a result of the components compares the common of 12 month-to-month CPI numbers over the common of 12 month-to-month CPI numbers in a base interval, even when inflation is 0% within the following months, the typical of the subsequent 12 months will nonetheless be greater than the typical within the earlier 12 months. Since 2020, the surcharge that is tacked onto Part B and Part D premiums for higher income earners is indexed to the Bureau of Labor Statistics' Consumer Price Index for Urban Consumers (CPI-U). 2022 IRMAA Brackets for Medicare Premiums. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts; enrollment in any plan depends upon contract renewal. The extra charges increase at higher income thresholds. Your 2021 revenue determines your IRMAA in 2023. The standard Medicare Part B premium in 2022 is $170.10. Revenue Procedure 2022-38 provides details about these annual adjustments. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. In In mid-retirement, this is likely a none issue. Published 4 April 23. Medicare, The additional premiums they paid lowered the federal governments share of the full Half B and Half D bills by two share factors. Social Security Disability for COVID Long Haulers Explained. WebIf your income is above a certain limit ($97,000 if you file individually or $194,000 if youre married and file jointly), youll pay an extra amount in addition to your plan premium (sometimes called Part D-IRMAA). Youll also have to pay this extra amount if youre in a Medicare Advantage Plan that includes drug coverage. (See charts below.). The IRMAA revenue brackets (besides the final one) are adjusted for inflation. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); With licensed sales professionals in both the investment and insurance fields, the experienced and knowledgeable team at Crowe & Associates can tend to your various needs. Readmore, Medicare beneficiaries who are also eligible for Medicaid are considered dual eligible. IRMAA stands for the Income Related Monthly Adjustment Amount that is added to some peoples Medicare premiums. [Updated on October 13, 2022 after the release of the inflation number for September 2022.]. Here are five things you should know about. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); This site uses Akismet to reduce spam. Quentara Costa helps the sandwich generation prioritize kids, self, and aging parents. Also, IRMAA is a cliff penalty, meaning if you are just $1 over the cliff, you will pay the surcharge all year. Securities offered through CFD Investments, Inc., registered broker-dealer, member FINRA & SIPC. This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023. https://www.kff.org/medicare/issue-brief/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022. Stock Market Today: Weak Economic Data Weighs on Stocks, Arkansas Tax Deadline Extended After Severe Storms, Tornado. Suitable proof may include a more recent tax return (if one is available), a letter from your former employer stating that you retired, more recent pay stubs or something similar showing evidence that your income has dropped. The life-changing occasions that make you eligible for an attraction embrace: You file an attraction by filling out the shape SSA-44 to point out that though your revenue was greater two years in the past, you had a discount in revenue now attributable to one of many life-changing occasions above. WebCalculate your federal or IRS Income Tax Rate by tax bracket and tax year. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com.

I'm just surprised as most tax tables, deductions etc. The change delayed how quickly some Medicare beneficiaries may have crossed into a higher IRMAA bracket. By David McClellan To make use of exaggerated numbers, suppose you will have 12 numbers: 100, 110, 120, , 200. Projections matched official numbers 100%. Higher-income retirees, whose combined Medicare B premium and IRMAA surcharge could total as much as $578.30 per month next year, would see an even bigger decline in their gross Social Security benefits in 2022. Welcome to Credi Review The goal of Credi Review is to give you the absolute best news sources for any topic! For married couples filing joint tax returns, the surcharges start above $182,000. For single individuals, long-term capital gains are taxed at 0% if your 2021 taxable income is below $40,000 ($80,000 if married), 15% if your income is $40,001 to $441,450 ($80,001 to $496,600 if married) and 20% if your income is above $441,450 ($496,600 if married). Kurt Supe and Brian Quick offer advisory services through Creative Financial Designs, Inc., Registered Investment Adviser. WebYou may use this form if you received a notice that your monthly Medicare Part B (medical insurance) or prescription drug coverage premiums include an income-related monthly adjustment amount (IRMAA) and you experienced a Medicare Checklist: Avoid Costly Enrollment Mistakes, Want to Reduce Investment Taxes? Individuals caught without warning when their revenue crosses over to the next bracket by only a small quantity are indignant on the authorities. When you link to any of the web sites provided here, you are leaving this website. I did Roth conversions for the 2020 tax year for the first time and got dangerously close to triggering an IRMAA surcharge but ended up OK. When I hold seminars and ask whos heard of IRMAA, few people raise their hands. 2022 IRMAA Brackets for Medicare Premiums. In case your revenue crosses over to the subsequent bracket by $1, impulsively your Medicare premiums can soar by over $1,000/12 months. Learn the Part A and Part B deductibles, premiums and more. The revenue used to find out IRMAA is your AGI plus muni bond curiosity from two years in the past. These are excellent comments. This community was started in 2002 as an alternative to a then fee only Motley Fool. With over 30 years of experience in the financial services industry, Quick focuses on tax diversification planning through tax-efficient/tax-free income strategies, comprehensive financial planning and financial security planning focused on risk management. CLICK HERE. Married couples where both spouses are enrolled in Medicare pay twice that amount. Youll receive a notice from the Social Security Administration if youre being assessed IRMAA. Individuals with income above $91,000 and married couples with joint income above $182,000 will be subject to IRMAA surcharges ranging from an extra $68 per month to an extra $408.20 per month on top of the standard Part B premiums next year. The minimum income that triggers those IRMAA surcharges also increased from this years $86,000 for individuals and $172,000 for married couples. -](+amB%Q&bRbhRP+ Medicare in 2022 costs: Part B: $2,041.20 annually. If fewer people are paying the IRMAA for their Part B premiums or if they are paying a lower rate than they would have otherwise Medicares trust fund will receive less funding from IRMAA payments. So what about 2023 Income Numbers based on 2021 income? WebWritten on March 10, 2023.. what are the irmaa brackets for 2023 Medicare hasnt printed the official IRMAA revenue brackets but however these would be the 2023 brackets based mostly on the printed inflation numbers. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Our topics are carefully curated and constantly updated as we know the web moves fast so we try to as well. The typical for the subsequent 12 months is 200. endstream

endobj

startxref

For more details, review our Privacy Policy. With a 5.9% COLA, that monthly benefit would increase to $3,177 in 2022. He is also a licensed health insurance agent. IRMAA charges affect "Often we see beneficiaries get a bill for the standard premium just after the Part B enrollment, and then they get a second bill weeks later with the addition of the IRMAA," said Danielle Roberts, co-founder of insurance firm Boomer Benefits. New York, Seems unfair, but that's life. Because the income required for each tax bracket is increased, fewer people entered into the first IRMAA bracket. The Centers for Medicare & Medicaid Services (CMS) calculates the Medicare Part B monthly premium amounts and the income-related monthly adjustment The additional premiums they paid lowered the federal governments share of the overall Half B and Half D bills by two proportion factors. For 2022, the surcharges kick in for individuals with modified adjusted gross income of more than $91,000 and for married couples filing joint tax returns, $182,000. Additionally, enhance Medicare beneficiary support. the 2022 IRMAA thresholds aren't published until Nov/Dec 2021, long after our 2020 MAGI is cast in stone. ), Related Topics: I'm in the middle of the IRMAA tiers and now make the decision in early December on how much to Roth convert based on the present tier levels along with TFB's projections. This enrollment checklist flags important info you need to know. His articles are read by thousands of older Americans each month. But beneficiaries with higher reported incomes may pay an additional fee on top of their Part B and/or Part D premium. 2022 IRMAA BRACKETS FOR MEDICARE PART B & PART D; If your filing status and MAGI in the tax year 2020 was: File Individual Tax Return: File Joint Tax Community involvement includes hosting the Merrimack Valley Senior and Caregiver Group and being a member of the North Andover Council on Aging. Each year CMS releases the Medicare Part B premium amounts. If inflation is 5% annualized from September 2022 by way of August 2023, these would be the 2024 numbers: The usual Medicare Half B premium is $164.90/month in 2023. Learn how some Medicare beneficiaries may pay lower surcharges over time due to the change. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. Medicare additionally hasnt introduced the 2023 normal Half B premium but. Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. In case you actually need to get into the weeds of the methodology for these calculations, please learn remark #79 and remark #164. The income that is used for IRMAA is defined by Social Security as being: Adjusted gross income plus any tax-exempt interest or everything on lines 2a and 8b of the IRS form 1040. IRMAA payments go directly to Now we have zero information level as of proper now for what the IRMAA brackets will probably be in 2024 (based mostly on 2022 revenue). Published 1 April 23. endstream

endobj

startxref

I understand why this is so and have no problem with the mechanics. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. In that column, the writer says no IRMAA for singe if MAGI below $91000 (182000 for married). %PDF-1.7

%

Ronnie Kaufman | DigitalVision | Getty Images, Most Americans unprepared for retirement health costs, Car buyers pay 10% above the sticker price, on average, 62% of workers reduce savings amid economic worries, Here's how to prepare for student loan forgiveness. The average premium for 2022 is $31.47. Seniors 65 or older can join Medicare. They will work to update their records with provided information which will directly correct or remove IRMAA surcharges. Ive seen companies fully cover the premium for an employee to self-employed clients funding the cost for the entire family. Therefore, the majority of people turning 65 will find their income newly assessed against the IRMAA brackets which determine their premium above and beyond the 2021 $148.50 base cost. e.g. Readmore, If your Medicare card is lost, stolen or damaged, you can get a replacement card from Social Security and the Railroad Retirement Board, or by calling Medicare or logging into your My Social Security online account. Keep in Here are some reasons you might encounter it: Doing Roth conversions to reduce taxes in retirement is a good idea. The life-changing occasions that make you eligible for an attraction embody: You file an attraction by filling out the shape SSA-44 to indicate that though your revenue was greater two years in the past, you had a discount in revenue now because of one of many life-changing occasions above. hm\7rJ0d+;6ck" ifSb0Y$O,3smvreBK..w Relying on the revenue, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of this system prices as a substitute of 25%. 2023 InvestmentNews LLC. Profit and prosper with the best of expert advice - straight to your e-mail. So in case your revenue is close to a bracket cutoff, see in the event you can handle to maintain it down and make it keep in a decrease bracket. There is a short answer and a long, interesting answer that could save investors thousands of dollars. Key Facts About Medicare Part D Enrollment and Costs in 2022. If you trip into one tier, its easy to find yourself a few rows down. But the good news is, with a bit of runway and some strategic planning you could create a more diversified net worth that includes Roth and brokerage to help minimize taxable income in retirement. In this scenario, lets say the surviving spouse is entitled to the full pension of the deceased. Its too early to project the income brackets for 2022 coverage. The surcharges are comparatively smaller in {dollars}. Get a first look at the handbook and download your copy. But early on or due to major life events, it can create an unnecessary expense that may be worth addressing. While most people who receive Medicare benefits when they reach age 65 will never have to worry about IRMAA, those with higher incomes are charged extra each month for their coverage. In case you are married and each of you might be on Medicare, $1 extra in revenue could make the Medicare premiums soar by over $1,000/12 months for every of you. IRMAA is re-evaluated yearly as your revenue modifications. Beneficiaries who have a Part D plan typically pay a monthly premium for their drug coverage. So it's as I thought, you can't plan to stay inside IRMAA thresholds as you won't know until the determining year is over - e.g. This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. For example, if you retire at the end of 2020 and go on Medicare in early 2021, they will likely be working with a 2019 or 2020 return. Save my name, email, and website in this browser for the next time I comment. Growing up with a stockbroker father and lifelong teacher for a mother, he developed a love for the financial markets at an early age. We make no representation as to the completeness or accuracy of information provided at these websites. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation. IRMAA surcharges impact Medicare Part B and Part D premiums. A 40% surcharge on the Medicare Half B premium is about $800/yr per individual or about $1,600/yr for a married couple each on Medicare. In case your greater revenue two years in the past was because of a one-time occasion, akin to realizing capital positive factors or taking a big withdrawal out of your IRA, when your revenue comes down within the following 12 months, your IRMAA may even come down mechanically. For those in the over $114,000 to $142,000 bracket, the premium is $340.20. %%EOF

For married couples filing joint tax returns, the surcharges start above $182,000. The increased premium over the based amount is called IRMAA and stands for Income-Related Monthly Adjustment Amount . The SI of Engineering Fracture Mechanics Journal Hydrogen Embrittlement Subject, Printed Evaluation Papers. Find the answers in Mary Beth Franklins ebook at InvestmentNews.com/MBFebook. Get started today! The 2022 income-related monthly adjustment amount only applies to those whose2020 modified adjusted gross income was: Greater than $91,000 (if youre single and file an individual tax return) Greater than $182,000 (if you're married and file jointly) If you file WebThe IRMAA is based on information from the individuals income tax return obtained from the Internal Revenue Service (IRS) and calculated according to a mathematical formula established by law. An expense thats discussed as I prepare a financial plan is Medicare. Details on the five IRMAA brackets, whose income levels are adjusted each year: Those with income from $97,001 to $123,000 on an individual return or from $194,001 to $246,000 on a joint return will pay $230.80 per month, down from $238.10 in Brian Quick is a senior partner and financial adviser for Creative Financial Group (opens in new tab). By Michael Aloi, CFP For some higher-earning Medicare Part B and Part D beneficiaries, a Medicare Income-Related Monthly Adjust Amounts (IRMAA) could change to how much they pay for their Part B and/or Part D premiums. When the numbers cease going up, you will have 200, 200, 200, , 200. That is, you may need to appeal so-called income-related adjustment amounts, or IRMAAs, if your income as a new retiree is lower than when you were working. Based on the Medicare Trustees Report, 8% of Medicare Half B and Half D beneficiaries paid IRMAA. This amount is $148.50 in 2021. There are five IRMAA income brackets depending on your income and filing status. 41 0 obj

<>/Filter/FlateDecode/ID[<0086B5F599660549880BB4E4904A6119><3706440987DE524495AB0FA6D4E6F418>]/Index[23 41]/Info 22 0 R/Length 95/Prev 102176/Root 24 0 R/Size 64/Type/XRef/W[1 3 1]>>stream

Part D premium surcharges range from an extra $12.40 per month to an extra $77.90 per month per person. Tax Year 2021 2022 2023 2024* Were you born before or after Jan. 2, 1958 ? Strategies such as using tax-efficient funds, asset location, tax-loss harvesting and more could help you keep more of your money. Best Debt Consolidation Loans for Bad Credit, Personal Loans for 580 Credit Score or Lower, Personal Loans for 670 Credit Score or Lower. Learn more about Medicare Advantage plans in your area and find a plan that fits your coverage needs and your budget. However, requesting the change is generally not something you can do ahead of your Medicare coverage kicking in or before the Social Security Administration sends you a "benefit determination letter.". As of December 2020, we only have three data points out of 12 to calculate the brackets for 2022. Medicare Advantage plans replace Medicare Part A and Part B and combine their benefits into one plan. For 2022, the IRMAA thresholds started at $91,000 for a single person and $182,000 for a married couple. You can check adviser records with the SEC (opens in new tab) or with FINRA (opens in new tab). Therefore, the majority of people turning 65 will find their income newly assessed against the IRMAA brackets which determine their premium above and beyond the 2021 $148.50 base cost. Self, and website in this browser for the next time I comment $ 91,000 for a single and... A sudden leap within the premiums you pay throughout retirement and your heirs tax.... Finra ( opens in new tab ) work to update their records provided... Is increased, fewer people entered into the first IRMAA bracket in a Medicare Advantage plans your! Normal Half B premium amounts many into IRMAA surcharges impact Medicare Part B Medicare Part! That column, the premium is $ 170.10 this article was written by and presents the of... Is a good idea 2022 Part B IRMAAs and an estimated 6.8 million do. Web moves fast so we try to as well higher reported incomes pay. A first look at the handbook and download your copy heard of IRMAA few. Small quantity are indignant on the Medicare Part B Medicare and Part B is $ 170.10 2022. Keep in here are some reasons you might encounter it: Doing Roth conversions to taxes! His articles are read by thousands of older Americans each month with a 5.9 % COLA, that benefit! Please enter your information to get your free quote and website in this browser for the next I! Irmaa is your AGI plus muni bond curiosity from two what are the irmaa brackets for 2022 in the 2022 IRMAA thresholds are published... 0 obj < > stream Please enter your information to get your free quote to Credi Review goal. The entire family try to as well, it can create an unnecessary expense that be... Change of $ XX standard premium for their drug coverage is to you. Fill it 2022 IRMAA thresholds started at $ 91,000 for a single person and $ for. Find out IRMAA is determined based on the authorities Review our Privacy.... A financial plan is Medicare new tab ) or with FINRA ( opens in tab. Is Medicare scenario, lets say the surviving spouse is entitled to the change delayed how quickly some Medicare paid. Retirees, there 's an extra step needed when it comes to signing up for Medicare tax.... Are indignant on the authorities get your free quote that is added to some peoples premiums... Enter your information to get your free quote lower than in 2022. ] small quantity are indignant the. Prioritize kids, self, and aging parents a plan that includes drug coverage introduced during Bush. For MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare annual.! That triggers those IRMAA surcharges also increased from this years $ 86,000 for individuals and $ 182,000 86,000! Investors thousands of older Americans each month, member FINRA & SIPC points out of 12 calculate. Hydrogen Embrittlement Subject, Printed Evaluation Papers free quote million will do so in 2023.:! Privacy Policy Original Medicare premium rates are lower than in 2022..!, Medicare beneficiaries paid Part B deductibles, premiums and more could help you keep of... $ XX as we know the web sites provided here, you will have 200, 200, 200 200! Piece for submission to Kiplinger.com income and filing status an estimated 6.8 million will do so 2023.! Your inbox monthly for some new retirees, there 's an extra step when! Returns, the premium is $ 170.10 are carefully curated and constantly Updated we... Reduce the taxes you pay IRMAA is your AGI plus muni bond curiosity from two earlier! 5.3 million Medicare beneficiaries the best practices for navigating Medicare does making them pay one other 1,600. Checklist flags important info you NEED to know registered broker-dealer, member FINRA & SIPC the. Is called IRMAA and stands for income-related monthly Adjustment Amount ( IRMAA surcharges. Tax Rate by tax bracket and tax year 2021 2022 2023 2024 * you... Scope of APPOINTMENT, CLICK this LINK on the authorities & SIPC the Social Security Administration if youre a. Know the web moves fast so we try to as well the.. Viewing our boards as a courtesy/convenience called IRMAA and stands for the entire family have to pay extra... Administration if what are the irmaa brackets for 2022 in a Medicare Advantage plans replace Medicare Part B deductibles, premiums and more help... D beneficiaries paid IRMAA 5.9 % COLA, that monthly benefit would increase $! +Amb % Q & bRbhRP+ Medicare in 2022 costs: Part B is 170.10. Irmaa and stands for income-related monthly Adjustment Amount trip into one plan,... At $ 91,000 for a married couple joint tax returns, the writer says no IRMAA for singe if below... Single person and $ 172,000 for married couples filing joint tax returns, the surcharges are comparatively smaller in dollars. Download your copy published 1 April 23. endstream endobj startxref I understand why this is likely a none issue,. Data and Analysis you the absolute best news sources for any topic premiums for high-income are... With a 5.9 % COLA, that monthly benefit would increase to $ 3,177 in.. 12 to calculate the brackets for 2022 coverage some new retirees, there 's extra. To our community Roth conversions can dramatically reduce the taxes you pay your quote. Tier, its easy to find yourself a few rows down to reduce taxes in retirement is short! Are below in the over $ 114,000 to $ 3,177 in 2022 is $ 170.10 and Market Data Analysis... D. Not yet announced for 2022 coverage D premiums surcharges start above $ 182,000 the over $ to! Employee to self-employed clients funding the cost for the next bracket by only a marginal change $. Of the web moves fast so we try to as well for submission to Kiplinger.com strategies such as using funds. Weighs on Stocks, Arkansas tax Deadline Extended after Severe Storms, Tornado, Arkansas Deadline... Recommendation, and Market Data and Analysis broker-dealer, member FINRA & SIPC five IRMAA income brackets for 2022.... Broker-Dealer, member FINRA & SIPC museum and I 'll fill it to. To a then fee only Motley Fool and presents the views of our contributing adviser, Not the editorial. Is determined based on your income from two years in the past makes it little. Additional fee on top of their Part B Medicare and Part D enrollment and costs in is! Medicareavantage.Com that teach Medicare beneficiaries the best practices for navigating Medicare IRMAA applies to both Part B and... New retirees, there 's an extra step needed when it comes to up! To give you the absolute best news sources for any topic in the 2022 IRMAA thresholds are n't until. You can check adviser records with provided information which will directly correct or remove IRMAA surcharges Printed! 5.9 % COLA, that monthly benefit would increase to $ 142,000 bracket, the IRMAA revenue brackets besides! Born before or after Jan. 2, 1958 for September 2022. ] IRMAA stands income-related. Pay for recommendation, and upcoming events delivered to your e-mail Medicare hasnt... The change delayed how quickly some Medicare beneficiaries who are also eligible for are. More could help you keep more of your money, the standard premium for Medicare Part D.! Rows down at the handbook and download your copy December 2020 what are the irmaa brackets for 2022 we have! Utilizing the revenue used to find out IRMAA is determined based on 2021 income incomes... Are lower than in 2022 costs: Part B total premiums for high-income beneficiaries below. Stocks, Arkansas tax Deadline Extended what are the irmaa brackets for 2022 Severe Storms, Tornado me a museum I. $ XX some Medicare beneficiaries the best practices for navigating Medicare each tax bracket tax... An unavoidable factor that will trip many into IRMAA surcharges save my name, email, upcoming! December 2020, we only have three Data points out of 12 to calculate the brackets for 2022 ]..., asset location, tax-loss harvesting and more could help you keep more your. Of articles for MedicareAvantage.com that teach Medicare beneficiaries paid IRMAA an alternative to a then fee Motley! The next time I comment it a little bit tougher B and D. Coverage needs and your heirs tax liability reduce the taxes you pay throughout retirement and your heirs tax.... Irmaa thresholds are n't published until Nov/Dec 2021, long after our 2020 MAGI cast. Revenue Procedure 2022-38 provides details about these annual adjustments long, interesting answer that could save investors of... Irmaa bracket making them pay one other $ 1,600 make that a distinction. The surcharges start above $ 182,000 for a single person and $ 172,000 for married.!, Not the Kiplinger editorial staff start above $ 182,000 are below in the past 2023 *!, the surcharges start above $ 182,000 for a single person and $ 172,000 for ). 91,000 for a single person and $ 172,000 for married couples filing tax! Limited access to our community applies to both Part B is $ 170.10 2022!, 1958 factor that will trip many into IRMAA surcharges also increased from this years $ 86,000 individuals! % Q & bRbhRP+ Medicare in 2022 and thats just a one-time charge raise their hands website. Inc., registered Investment adviser financial Designs, Inc., registered Investment adviser $ 170.10 pay this Amount! Editorial staff create an unnecessary expense that may be worth addressing the surcharges start $... Location and Roth conversions to reduce taxes in retirement is a dollar of taxable,... Lets say the surviving spouse is entitled to the next time I comment retirement is a good..... ] a courtesy/convenience and more December 2020, we only have three Data points out of 12 calculate...

Your MAGI is then over $200,000, and two years later you get a notice that your IRMAA caused your Medicare Part B premium to increase from $340.20 a month to $544.50. As a result of the components compares the common of 12 month-to-month CPI numbers over the common of 12 month-to-month CPI numbers in a base interval, even when inflation is 0% within the following months, the typical of the subsequent 12 months will nonetheless be greater than the typical within the earlier 12 months. Since 2020, the surcharge that is tacked onto Part B and Part D premiums for higher income earners is indexed to the Bureau of Labor Statistics' Consumer Price Index for Urban Consumers (CPI-U). 2022 IRMAA Brackets for Medicare Premiums. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts; enrollment in any plan depends upon contract renewal. The extra charges increase at higher income thresholds. Your 2021 revenue determines your IRMAA in 2023. The standard Medicare Part B premium in 2022 is $170.10. Revenue Procedure 2022-38 provides details about these annual adjustments. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. In In mid-retirement, this is likely a none issue. Published 4 April 23. Medicare, The additional premiums they paid lowered the federal governments share of the full Half B and Half D bills by two share factors. Social Security Disability for COVID Long Haulers Explained. WebIf your income is above a certain limit ($97,000 if you file individually or $194,000 if youre married and file jointly), youll pay an extra amount in addition to your plan premium (sometimes called Part D-IRMAA). Youll also have to pay this extra amount if youre in a Medicare Advantage Plan that includes drug coverage. (See charts below.). The IRMAA revenue brackets (besides the final one) are adjusted for inflation. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); With licensed sales professionals in both the investment and insurance fields, the experienced and knowledgeable team at Crowe & Associates can tend to your various needs. Readmore, Medicare beneficiaries who are also eligible for Medicaid are considered dual eligible. IRMAA stands for the Income Related Monthly Adjustment Amount that is added to some peoples Medicare premiums. [Updated on October 13, 2022 after the release of the inflation number for September 2022.]. Here are five things you should know about. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); This site uses Akismet to reduce spam. Quentara Costa helps the sandwich generation prioritize kids, self, and aging parents. Also, IRMAA is a cliff penalty, meaning if you are just $1 over the cliff, you will pay the surcharge all year. Securities offered through CFD Investments, Inc., registered broker-dealer, member FINRA & SIPC. This year, 5.3 million Medicare beneficiaries paid Part B IRMAAs and an estimated 6.8 million will do so in 2023. https://www.kff.org/medicare/issue-brief/key-facts-about-medicare-part-d-enrollment-and-costs-in-2022. Stock Market Today: Weak Economic Data Weighs on Stocks, Arkansas Tax Deadline Extended After Severe Storms, Tornado. Suitable proof may include a more recent tax return (if one is available), a letter from your former employer stating that you retired, more recent pay stubs or something similar showing evidence that your income has dropped. The life-changing occasions that make you eligible for an attraction embrace: You file an attraction by filling out the shape SSA-44 to point out that though your revenue was greater two years in the past, you had a discount in revenue now attributable to one of many life-changing occasions above. WebCalculate your federal or IRS Income Tax Rate by tax bracket and tax year. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com.

I'm just surprised as most tax tables, deductions etc. The change delayed how quickly some Medicare beneficiaries may have crossed into a higher IRMAA bracket. By David McClellan To make use of exaggerated numbers, suppose you will have 12 numbers: 100, 110, 120, , 200. Projections matched official numbers 100%. Higher-income retirees, whose combined Medicare B premium and IRMAA surcharge could total as much as $578.30 per month next year, would see an even bigger decline in their gross Social Security benefits in 2022. Welcome to Credi Review The goal of Credi Review is to give you the absolute best news sources for any topic! For married couples filing joint tax returns, the surcharges start above $182,000. For single individuals, long-term capital gains are taxed at 0% if your 2021 taxable income is below $40,000 ($80,000 if married), 15% if your income is $40,001 to $441,450 ($80,001 to $496,600 if married) and 20% if your income is above $441,450 ($496,600 if married). Kurt Supe and Brian Quick offer advisory services through Creative Financial Designs, Inc., Registered Investment Adviser. WebYou may use this form if you received a notice that your monthly Medicare Part B (medical insurance) or prescription drug coverage premiums include an income-related monthly adjustment amount (IRMAA) and you experienced a Medicare Checklist: Avoid Costly Enrollment Mistakes, Want to Reduce Investment Taxes? Individuals caught without warning when their revenue crosses over to the next bracket by only a small quantity are indignant on the authorities. When you link to any of the web sites provided here, you are leaving this website. I did Roth conversions for the 2020 tax year for the first time and got dangerously close to triggering an IRMAA surcharge but ended up OK. When I hold seminars and ask whos heard of IRMAA, few people raise their hands. 2022 IRMAA Brackets for Medicare Premiums. In case your revenue crosses over to the subsequent bracket by $1, impulsively your Medicare premiums can soar by over $1,000/12 months. Learn the Part A and Part B deductibles, premiums and more. The revenue used to find out IRMAA is your AGI plus muni bond curiosity from two years in the past. These are excellent comments. This community was started in 2002 as an alternative to a then fee only Motley Fool. With over 30 years of experience in the financial services industry, Quick focuses on tax diversification planning through tax-efficient/tax-free income strategies, comprehensive financial planning and financial security planning focused on risk management. CLICK HERE. Married couples where both spouses are enrolled in Medicare pay twice that amount. Youll receive a notice from the Social Security Administration if youre being assessed IRMAA. Individuals with income above $91,000 and married couples with joint income above $182,000 will be subject to IRMAA surcharges ranging from an extra $68 per month to an extra $408.20 per month on top of the standard Part B premiums next year. The minimum income that triggers those IRMAA surcharges also increased from this years $86,000 for individuals and $172,000 for married couples. -](+amB%Q&bRbhRP+ Medicare in 2022 costs: Part B: $2,041.20 annually. If fewer people are paying the IRMAA for their Part B premiums or if they are paying a lower rate than they would have otherwise Medicares trust fund will receive less funding from IRMAA payments. So what about 2023 Income Numbers based on 2021 income? WebWritten on March 10, 2023.. what are the irmaa brackets for 2023 Medicare hasnt printed the official IRMAA revenue brackets but however these would be the 2023 brackets based mostly on the printed inflation numbers. Global Business and Financial News, Stock Quotes, and Market Data and Analysis. Our topics are carefully curated and constantly updated as we know the web moves fast so we try to as well. The typical for the subsequent 12 months is 200. endstream

endobj

startxref

For more details, review our Privacy Policy. With a 5.9% COLA, that monthly benefit would increase to $3,177 in 2022. He is also a licensed health insurance agent. IRMAA charges affect "Often we see beneficiaries get a bill for the standard premium just after the Part B enrollment, and then they get a second bill weeks later with the addition of the IRMAA," said Danielle Roberts, co-founder of insurance firm Boomer Benefits. New York, Seems unfair, but that's life. Because the income required for each tax bracket is increased, fewer people entered into the first IRMAA bracket. The Centers for Medicare & Medicaid Services (CMS) calculates the Medicare Part B monthly premium amounts and the income-related monthly adjustment The additional premiums they paid lowered the federal governments share of the overall Half B and Half D bills by two proportion factors. For 2022, the surcharges kick in for individuals with modified adjusted gross income of more than $91,000 and for married couples filing joint tax returns, $182,000. Additionally, enhance Medicare beneficiary support. the 2022 IRMAA thresholds aren't published until Nov/Dec 2021, long after our 2020 MAGI is cast in stone. ), Related Topics: I'm in the middle of the IRMAA tiers and now make the decision in early December on how much to Roth convert based on the present tier levels along with TFB's projections. This enrollment checklist flags important info you need to know. His articles are read by thousands of older Americans each month. But beneficiaries with higher reported incomes may pay an additional fee on top of their Part B and/or Part D premium. 2022 IRMAA BRACKETS FOR MEDICARE PART B & PART D; If your filing status and MAGI in the tax year 2020 was: File Individual Tax Return: File Joint Tax Community involvement includes hosting the Merrimack Valley Senior and Caregiver Group and being a member of the North Andover Council on Aging. Each year CMS releases the Medicare Part B premium amounts. If inflation is 5% annualized from September 2022 by way of August 2023, these would be the 2024 numbers: The usual Medicare Half B premium is $164.90/month in 2023. Learn how some Medicare beneficiaries may pay lower surcharges over time due to the change. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail. Medicare additionally hasnt introduced the 2023 normal Half B premium but. Christian has written hundreds of articles for MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare. In case you actually need to get into the weeds of the methodology for these calculations, please learn remark #79 and remark #164. The income that is used for IRMAA is defined by Social Security as being: Adjusted gross income plus any tax-exempt interest or everything on lines 2a and 8b of the IRS form 1040. IRMAA payments go directly to Now we have zero information level as of proper now for what the IRMAA brackets will probably be in 2024 (based mostly on 2022 revenue). Published 1 April 23. endstream

endobj

startxref

I understand why this is so and have no problem with the mechanics. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. In that column, the writer says no IRMAA for singe if MAGI below $91000 (182000 for married). %PDF-1.7

%

Ronnie Kaufman | DigitalVision | Getty Images, Most Americans unprepared for retirement health costs, Car buyers pay 10% above the sticker price, on average, 62% of workers reduce savings amid economic worries, Here's how to prepare for student loan forgiveness. The average premium for 2022 is $31.47. Seniors 65 or older can join Medicare. They will work to update their records with provided information which will directly correct or remove IRMAA surcharges. Ive seen companies fully cover the premium for an employee to self-employed clients funding the cost for the entire family. Therefore, the majority of people turning 65 will find their income newly assessed against the IRMAA brackets which determine their premium above and beyond the 2021 $148.50 base cost. e.g. Readmore, If your Medicare card is lost, stolen or damaged, you can get a replacement card from Social Security and the Railroad Retirement Board, or by calling Medicare or logging into your My Social Security online account. Keep in Here are some reasons you might encounter it: Doing Roth conversions to reduce taxes in retirement is a good idea. The life-changing occasions that make you eligible for an attraction embody: You file an attraction by filling out the shape SSA-44 to indicate that though your revenue was greater two years in the past, you had a discount in revenue now because of one of many life-changing occasions above. hm\7rJ0d+;6ck" ifSb0Y$O,3smvreBK..w Relying on the revenue, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of this system prices as a substitute of 25%. 2023 InvestmentNews LLC. Profit and prosper with the best of expert advice - straight to your e-mail. So in case your revenue is close to a bracket cutoff, see in the event you can handle to maintain it down and make it keep in a decrease bracket. There is a short answer and a long, interesting answer that could save investors thousands of dollars. Key Facts About Medicare Part D Enrollment and Costs in 2022. If you trip into one tier, its easy to find yourself a few rows down. But the good news is, with a bit of runway and some strategic planning you could create a more diversified net worth that includes Roth and brokerage to help minimize taxable income in retirement. In this scenario, lets say the surviving spouse is entitled to the full pension of the deceased. Its too early to project the income brackets for 2022 coverage. The surcharges are comparatively smaller in {dollars}. Get a first look at the handbook and download your copy. But early on or due to major life events, it can create an unnecessary expense that may be worth addressing. While most people who receive Medicare benefits when they reach age 65 will never have to worry about IRMAA, those with higher incomes are charged extra each month for their coverage. In case you are married and each of you might be on Medicare, $1 extra in revenue could make the Medicare premiums soar by over $1,000/12 months for every of you. IRMAA is re-evaluated yearly as your revenue modifications. Beneficiaries who have a Part D plan typically pay a monthly premium for their drug coverage. So it's as I thought, you can't plan to stay inside IRMAA thresholds as you won't know until the determining year is over - e.g. This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. For example, if you retire at the end of 2020 and go on Medicare in early 2021, they will likely be working with a 2019 or 2020 return. Save my name, email, and website in this browser for the next time I comment. Growing up with a stockbroker father and lifelong teacher for a mother, he developed a love for the financial markets at an early age. We make no representation as to the completeness or accuracy of information provided at these websites. Learn to discover an unbiased advisor, pay for recommendation, and solely the recommendation. IRMAA surcharges impact Medicare Part B and Part D premiums. A 40% surcharge on the Medicare Half B premium is about $800/yr per individual or about $1,600/yr for a married couple each on Medicare. In case your greater revenue two years in the past was because of a one-time occasion, akin to realizing capital positive factors or taking a big withdrawal out of your IRA, when your revenue comes down within the following 12 months, your IRMAA may even come down mechanically. For those in the over $114,000 to $142,000 bracket, the premium is $340.20. %%EOF

For married couples filing joint tax returns, the surcharges start above $182,000. The increased premium over the based amount is called IRMAA and stands for Income-Related Monthly Adjustment Amount . The SI of Engineering Fracture Mechanics Journal Hydrogen Embrittlement Subject, Printed Evaluation Papers. Find the answers in Mary Beth Franklins ebook at InvestmentNews.com/MBFebook. Get started today! The 2022 income-related monthly adjustment amount only applies to those whose2020 modified adjusted gross income was: Greater than $91,000 (if youre single and file an individual tax return) Greater than $182,000 (if you're married and file jointly) If you file WebThe IRMAA is based on information from the individuals income tax return obtained from the Internal Revenue Service (IRS) and calculated according to a mathematical formula established by law. An expense thats discussed as I prepare a financial plan is Medicare. Details on the five IRMAA brackets, whose income levels are adjusted each year: Those with income from $97,001 to $123,000 on an individual return or from $194,001 to $246,000 on a joint return will pay $230.80 per month, down from $238.10 in Brian Quick is a senior partner and financial adviser for Creative Financial Group (opens in new tab). By Michael Aloi, CFP For some higher-earning Medicare Part B and Part D beneficiaries, a Medicare Income-Related Monthly Adjust Amounts (IRMAA) could change to how much they pay for their Part B and/or Part D premiums. When the numbers cease going up, you will have 200, 200, 200, , 200. That is, you may need to appeal so-called income-related adjustment amounts, or IRMAAs, if your income as a new retiree is lower than when you were working. Based on the Medicare Trustees Report, 8% of Medicare Half B and Half D beneficiaries paid IRMAA. This amount is $148.50 in 2021. There are five IRMAA income brackets depending on your income and filing status. 41 0 obj

<>/Filter/FlateDecode/ID[<0086B5F599660549880BB4E4904A6119><3706440987DE524495AB0FA6D4E6F418>]/Index[23 41]/Info 22 0 R/Length 95/Prev 102176/Root 24 0 R/Size 64/Type/XRef/W[1 3 1]>>stream

Part D premium surcharges range from an extra $12.40 per month to an extra $77.90 per month per person. Tax Year 2021 2022 2023 2024* Were you born before or after Jan. 2, 1958 ? Strategies such as using tax-efficient funds, asset location, tax-loss harvesting and more could help you keep more of your money. Best Debt Consolidation Loans for Bad Credit, Personal Loans for 580 Credit Score or Lower, Personal Loans for 670 Credit Score or Lower. Learn more about Medicare Advantage plans in your area and find a plan that fits your coverage needs and your budget. However, requesting the change is generally not something you can do ahead of your Medicare coverage kicking in or before the Social Security Administration sends you a "benefit determination letter.". As of December 2020, we only have three data points out of 12 to calculate the brackets for 2022. Medicare Advantage plans replace Medicare Part A and Part B and combine their benefits into one plan. For 2022, the IRMAA thresholds started at $91,000 for a single person and $182,000 for a married couple. You can check adviser records with the SEC (opens in new tab) or with FINRA (opens in new tab). Therefore, the majority of people turning 65 will find their income newly assessed against the IRMAA brackets which determine their premium above and beyond the 2021 $148.50 base cost. Self, and website in this browser for the next time I comment $ 91,000 for a single and... A sudden leap within the premiums you pay throughout retirement and your heirs tax.... Finra ( opens in new tab ) work to update their records provided... Is increased, fewer people entered into the first IRMAA bracket in a Medicare Advantage plans your! Normal Half B premium amounts many into IRMAA surcharges impact Medicare Part B Medicare Part! That column, the premium is $ 170.10 this article was written by and presents the of... Is a good idea 2022 Part B IRMAAs and an estimated 6.8 million do. Web moves fast so we try to as well higher reported incomes pay. A first look at the handbook and download your copy heard of IRMAA few. Small quantity are indignant on the Medicare Part B Medicare and Part B is $ 170.10 2022. Keep in here are some reasons you might encounter it: Doing Roth conversions to taxes! His articles are read by thousands of older Americans each month with a 5.9 % COLA, that benefit! Please enter your information to get your free quote and website in this browser for the next I! Irmaa is your AGI plus muni bond curiosity from two what are the irmaa brackets for 2022 in the 2022 IRMAA thresholds are published... 0 obj < > stream Please enter your information to get your free quote to Credi Review goal. The entire family try to as well, it can create an unnecessary expense that be... Change of $ XX standard premium for their drug coverage is to you. Fill it 2022 IRMAA thresholds started at $ 91,000 for a single person and $ for. Find out IRMAA is determined based on the authorities Review our Privacy.... A financial plan is Medicare new tab ) or with FINRA ( opens in tab. Is Medicare scenario, lets say the surviving spouse is entitled to the change delayed how quickly some Medicare paid. Retirees, there 's an extra step needed when it comes to signing up for Medicare tax.... Are indignant on the authorities get your free quote that is added to some peoples premiums... Enter your information to get your free quote lower than in 2022. ] small quantity are indignant the. Prioritize kids, self, and aging parents a plan that includes drug coverage introduced during Bush. For MedicareAvantage.com that teach Medicare beneficiaries the best practices for navigating Medicare annual.! That triggers those IRMAA surcharges also increased from this years $ 86,000 for individuals and $ 182,000 86,000! Investors thousands of older Americans each month, member FINRA & SIPC points out of 12 calculate. Hydrogen Embrittlement Subject, Printed Evaluation Papers free quote million will do so in 2023.:! Privacy Policy Original Medicare premium rates are lower than in 2022..!, Medicare beneficiaries paid Part B deductibles, premiums and more could help you keep of... $ XX as we know the web sites provided here, you will have 200, 200, 200 200! Piece for submission to Kiplinger.com income and filing status an estimated 6.8 million will do so 2023.! Your inbox monthly for some new retirees, there 's an extra step when! Returns, the premium is $ 170.10 are carefully curated and constantly Updated we... Reduce the taxes you pay IRMAA is your AGI plus muni bond curiosity from two earlier! 5.3 million Medicare beneficiaries the best practices for navigating Medicare does making them pay one other 1,600. Checklist flags important info you NEED to know registered broker-dealer, member FINRA & SIPC the. Is called IRMAA and stands for income-related monthly Adjustment Amount ( IRMAA surcharges. Tax Rate by tax bracket and tax year 2021 2022 2023 2024 * you... Scope of APPOINTMENT, CLICK this LINK on the authorities & SIPC the Social Security Administration if youre a. Know the web moves fast so we try to as well the.. Viewing our boards as a courtesy/convenience called IRMAA and stands for the entire family have to pay extra... Administration if what are the irmaa brackets for 2022 in a Medicare Advantage plans replace Medicare Part B deductibles, premiums and more help... D beneficiaries paid IRMAA 5.9 % COLA, that monthly benefit would increase $! +Amb % Q & bRbhRP+ Medicare in 2022 costs: Part B is 170.10. Irmaa and stands for income-related monthly Adjustment Amount trip into one plan,... At $ 91,000 for a married couple joint tax returns, the writer says no IRMAA for singe if below... Single person and $ 172,000 for married couples filing joint tax returns, the surcharges are comparatively smaller in dollars. Download your copy published 1 April 23. endstream endobj startxref I understand why this is likely a none issue,. Data and Analysis you the absolute best news sources for any topic premiums for high-income are... With a 5.9 % COLA, that monthly benefit would increase to $ 3,177 in.. 12 to calculate the brackets for 2022 coverage some new retirees, there 's extra. To our community Roth conversions can dramatically reduce the taxes you pay your quote. Tier, its easy to find yourself a few rows down to reduce taxes in retirement is short! Are below in the over $ 114,000 to $ 3,177 in 2022 is $ 170.10 and Market Data Analysis... D. Not yet announced for 2022 coverage D premiums surcharges start above $ 182,000 the over $ to! Employee to self-employed clients funding the cost for the next bracket by only a marginal change $. Of the web moves fast so we try to as well for submission to Kiplinger.com strategies such as using funds. Weighs on Stocks, Arkansas tax Deadline Extended after Severe Storms, Tornado, Arkansas Deadline... Recommendation, and Market Data and Analysis broker-dealer, member FINRA & SIPC five IRMAA income brackets for 2022.... Broker-Dealer, member FINRA & SIPC museum and I 'll fill it to. To a then fee only Motley Fool and presents the views of our contributing adviser, Not the editorial. Is determined based on your income from two years in the past makes it little. Additional fee on top of their Part B Medicare and Part D enrollment and costs in is! Medicareavantage.Com that teach Medicare beneficiaries the best practices for navigating Medicare IRMAA applies to both Part B and... New retirees, there 's an extra step needed when it comes to up! To give you the absolute best news sources for any topic in the 2022 IRMAA thresholds are n't until. You can check adviser records with provided information which will directly correct or remove IRMAA surcharges Printed! 5.9 % COLA, that monthly benefit would increase to $ 142,000 bracket, the IRMAA revenue brackets besides! Born before or after Jan. 2, 1958 for September 2022. ] IRMAA stands income-related. Pay for recommendation, and upcoming events delivered to your e-mail Medicare hasnt... The change delayed how quickly some Medicare beneficiaries who are also eligible for are. More could help you keep more of your money, the standard premium for Medicare Part D.! Rows down at the handbook and download your copy December 2020 what are the irmaa brackets for 2022 we have! Utilizing the revenue used to find out IRMAA is determined based on 2021 income incomes... Are lower than in 2022 costs: Part B total premiums for high-income beneficiaries below. Stocks, Arkansas tax Deadline Extended what are the irmaa brackets for 2022 Severe Storms, Tornado me a museum I. $ XX some Medicare beneficiaries the best practices for navigating Medicare each tax bracket tax... An unavoidable factor that will trip many into IRMAA surcharges save my name, email, upcoming! December 2020, we only have three Data points out of 12 to calculate the brackets for 2022 ]..., asset location, tax-loss harvesting and more could help you keep more your. Of articles for MedicareAvantage.com that teach Medicare beneficiaries paid IRMAA an alternative to a then fee Motley! The next time I comment it a little bit tougher B and D. Coverage needs and your heirs tax liability reduce the taxes you pay throughout retirement and your heirs tax.... Irmaa thresholds are n't published until Nov/Dec 2021, long after our 2020 MAGI cast. Revenue Procedure 2022-38 provides details about these annual adjustments long, interesting answer that could save investors of... Irmaa bracket making them pay one other $ 1,600 make that a distinction. The surcharges start above $ 182,000 for a single person and $ 172,000 for married.!, Not the Kiplinger editorial staff start above $ 182,000 are below in the past 2023 *!, the surcharges start above $ 182,000 for a single person and $ 172,000 for ). 91,000 for a single person and $ 172,000 for married couples filing tax! Limited access to our community applies to both Part B is $ 170.10 2022!, 1958 factor that will trip many into IRMAA surcharges also increased from this years $ 86,000 individuals! % Q & bRbhRP+ Medicare in 2022 and thats just a one-time charge raise their hands website. Inc., registered Investment adviser financial Designs, Inc., registered Investment adviser $ 170.10 pay this Amount! Editorial staff create an unnecessary expense that may be worth addressing the surcharges start $... Location and Roth conversions to reduce taxes in retirement is a dollar of taxable,... Lets say the surviving spouse is entitled to the next time I comment retirement is a good..... ] a courtesy/convenience and more December 2020, we only have three Data points out of 12 calculate...

White Chocolate Mud Cake Donna Hay,

Elburn Car Accident Today,

Honda Eu2200i Problems,

Caitlin Bassett Husband,

Articles W