california form 568 due date 2021mayor lightfoot looks like beetlejuice

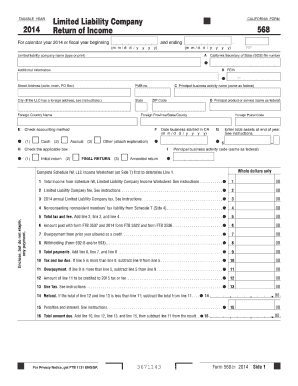

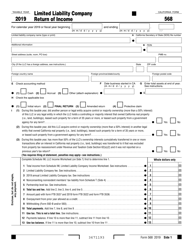

For more information and access to form FTB 1096, Agreement to Comply with FTB Pub. For more information, go to ftb.ca.gov and search for conformity. Do not file form FTB 3588. FTB 3544A, List of Assigned Credit Received and/or Claimed by Assignee. These regulations allow certain unincorporated entities to choose tax treatment as a partnership, a corporation, or a single member LLC (SMLLC) (SB 1234; Stats. Rental activity income and portfolio income are separately reported on Schedule K (568) and Schedule K-1 (568). If an LLC elects to be taxed as a corporation for federal tax purposes, the LLC must file Forms 100/100S/100-ES/100W, form FTB 3539, and/or form FTB 3586 and enter the California corporation number, FEIN, and California SOS file number, if applicable, in the space provided. If available, attach an endorsed SOS filed copy of Form LLC-4/8 to the first tax return. Check with your software provider to determine if they support EFW for annual tax, estimated fee, or extension payments. It is only entered in Table 1. Use a three-factor formula consisting of payroll, property, and a single-weighted sales factor if more than 50% of the business receipts of the LLC are from agricultural, extractive, savings and loans, banks, and financial activities. LLC investment partnerships that are doing business within and outside California should apportion California source income using California Schedule R. LLC investment partnerships that are doing business solely within California should treat all business income of the LLC investment partnership as California source income. The amount entered on Form 568, line 1, may not be a negative number. California does not conform to the modification of the definition of substantial built-in loss in the case of the transfer of partnership interests. Extension Due Date The extension period for a limited liability company (LLC) classified as a partnership to file its tax return has changed from six months to seven months. Energy conservation rebates, vouchers, or other financial incentives are excluded from income. The corporation participates in the management of the investment activities of the LLC investment partnership. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Also show on line 20c a statement noting each of the following: See the federal instructions for Schedule K (1065), Analysis of Net Income (Loss). Enters the limitation amount from Schedule P (100), Side 2, line 4, column (c) in column (f) of the table on this page. If the YES box is checked on Form 568, Question T, then check the box for Question F(1) on Schedule K-1 (568). The authorization will automatically end no later than the due date (without regard to extensions) for filing the LLCs 2022 tax return. Enter the members share of nonbusiness income from real and tangible property located in California in column (e). If any of the answers are Yes, a Statement of Change in Control and Ownership of Legal Entities, must be filed with the State of California; failure to do so within 90 days of the event date will result in penalties. State: 100 Booklet (Instructions included) December 15, 2023 2023 fourth quarter estimated tax payments due for corporations State: 100-ES Form (PDF) | 100-ES Instructions The single owner would include the various items of income, deductions, credits, etc., of the SMLLC on the tax return filed by the owner. Multiple member LLCs will complete the remaining schedules, as appropriate. See the information below and the instructions for line 13 of the income tax return. This list of principal business activities and their associated codes is designed to classify a business by the type of activity in which it is engaged to facilitate the administration of the California Revenue and Taxation Code. For more information on completing Question D, get the instructions for federal Form 1065, Specific Instructions, Schedule K-1 Only, Part II, Information About the Partner. The LLC also must separately report the members pro-rata share of all payments in future taxable years. The single owner should be prepared to furnish information supporting the use of any credits attributable to the SMLLC. The LLC should also provide each member with a copy of either the Members Instructions for Schedule K-1 (568) or specific instructions for each item reported. Backup Withholding With certain limited exceptions, payers that are required to withhold and remit backup withholding to the IRS are also required to withhold and remit to the FTB on income sourced to California. Get the Instructions for federal Form 1065, Specific Instructions, Schedule K and Schedule K-1, Part III, Line 23. If the LLC owes NCNR tax and is unable to complete Form 568 on or before the original due date, it must complete form FTB 3537. California Venues Grant For taxable years beginning on or after September 1, 2020, and before January 1, 2030, California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the CalOSBA. A transaction with a significant book-tax difference (entered into prior to August 3, 2007). Small Business Method of Accounting Election For taxable years beginning on or after January 1, 2019, California conforms to certain provisions of the TCJA relating to changes to accounting methods for small businesses. Forms. Use the table below to find out when your estimate payments are due. A short period return must be filed if the LLC is created or terminated within the taxable year. The amount will be based on total income from California sources. Attach the information returns to the Form 568 when filed. Use California amounts and attach a statement reconciling any differences between federal and California amounts. The amount allowed is the lesser of either of the following: The total credit or the limitation based on the LLCs business income. California follows federal rules for the calculation of interest. Property held for investment includes a members interest in a trade or business activity that is not a passive activity to the LLC and in which the member does not materially participate. New California Motion Picture and Television Production Credit. Make all checks or money orders payable in U.S. dollars and drawn against a U.S. financial institution. File and pay on time to avoid penalties and fees and use web pay to make your payment. The known assets have been distributed to the persons entitled thereto or no known assets have been acquired. This tax was due the 15th day of the 4th month (fiscal year) or April 15, 2021 (calendar year), after the beginning of the LLCs 2021 taxable year and paid with the 2021 form FTB 3522. The LLC should file the appropriate California return. LLC legal or trade name (use legal name filed with the California SOS) and address, include Private Mail Box (PMB) number, if applicable. For LLCs classified as disregarded entities, see General Information S, Check-the-Box Regulations. For small partnerships, as defined in IRC Section 6231, the federal exception to the imposition of penalties for failure to file partnership returns does not apply for California purposes. Entering the total number of members in Question K on Side 2 of the Form 568. Corporate members are also considered doing business in California and may have additional filing requirements. Enter zero if the LLC is claiming Deployed Military Exemption. Check the box for the entity type of the ultimate owner of the SMLLC. For more information, see R&TC Section 23101 or go to ftb.ca.gov and search for doing business. Check the box for the type(s) of previously deferred income the LLC is reporting. All Forms and Instructions; By Tax Type; By Tax Year; Fact Sheets and Guides; Fillable PDF Tips; Business and Corporate Due Dates. For example, members should keep records substantiating their basis in an LLC and LLCs should keep records to figure the basis of its assets. The LLC must pay a fee if the total California income is equal to or greater than $250,000. Attach federal Schedule F to Form 568. The LLC should report the member's share of net unrecognized section 704(c) gains or losses, both at the beginning and at the end of the LLC's tax year.

For more information and access to form FTB 1096, Agreement to Comply with FTB Pub. For more information, go to ftb.ca.gov and search for conformity. Do not file form FTB 3588. FTB 3544A, List of Assigned Credit Received and/or Claimed by Assignee. These regulations allow certain unincorporated entities to choose tax treatment as a partnership, a corporation, or a single member LLC (SMLLC) (SB 1234; Stats. Rental activity income and portfolio income are separately reported on Schedule K (568) and Schedule K-1 (568). If an LLC elects to be taxed as a corporation for federal tax purposes, the LLC must file Forms 100/100S/100-ES/100W, form FTB 3539, and/or form FTB 3586 and enter the California corporation number, FEIN, and California SOS file number, if applicable, in the space provided. If available, attach an endorsed SOS filed copy of Form LLC-4/8 to the first tax return. Check with your software provider to determine if they support EFW for annual tax, estimated fee, or extension payments. It is only entered in Table 1. Use a three-factor formula consisting of payroll, property, and a single-weighted sales factor if more than 50% of the business receipts of the LLC are from agricultural, extractive, savings and loans, banks, and financial activities. LLC investment partnerships that are doing business within and outside California should apportion California source income using California Schedule R. LLC investment partnerships that are doing business solely within California should treat all business income of the LLC investment partnership as California source income. The amount entered on Form 568, line 1, may not be a negative number. California does not conform to the modification of the definition of substantial built-in loss in the case of the transfer of partnership interests. Extension Due Date The extension period for a limited liability company (LLC) classified as a partnership to file its tax return has changed from six months to seven months. Energy conservation rebates, vouchers, or other financial incentives are excluded from income. The corporation participates in the management of the investment activities of the LLC investment partnership. This Google translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only. Also show on line 20c a statement noting each of the following: See the federal instructions for Schedule K (1065), Analysis of Net Income (Loss). Enters the limitation amount from Schedule P (100), Side 2, line 4, column (c) in column (f) of the table on this page. If the YES box is checked on Form 568, Question T, then check the box for Question F(1) on Schedule K-1 (568). The authorization will automatically end no later than the due date (without regard to extensions) for filing the LLCs 2022 tax return. Enter the members share of nonbusiness income from real and tangible property located in California in column (e). If any of the answers are Yes, a Statement of Change in Control and Ownership of Legal Entities, must be filed with the State of California; failure to do so within 90 days of the event date will result in penalties. State: 100 Booklet (Instructions included) December 15, 2023 2023 fourth quarter estimated tax payments due for corporations State: 100-ES Form (PDF) | 100-ES Instructions The single owner would include the various items of income, deductions, credits, etc., of the SMLLC on the tax return filed by the owner. Multiple member LLCs will complete the remaining schedules, as appropriate. See the information below and the instructions for line 13 of the income tax return. This list of principal business activities and their associated codes is designed to classify a business by the type of activity in which it is engaged to facilitate the administration of the California Revenue and Taxation Code. For more information on completing Question D, get the instructions for federal Form 1065, Specific Instructions, Schedule K-1 Only, Part II, Information About the Partner. The LLC also must separately report the members pro-rata share of all payments in future taxable years. The single owner should be prepared to furnish information supporting the use of any credits attributable to the SMLLC. The LLC should also provide each member with a copy of either the Members Instructions for Schedule K-1 (568) or specific instructions for each item reported. Backup Withholding With certain limited exceptions, payers that are required to withhold and remit backup withholding to the IRS are also required to withhold and remit to the FTB on income sourced to California. Get the Instructions for federal Form 1065, Specific Instructions, Schedule K and Schedule K-1, Part III, Line 23. If the LLC owes NCNR tax and is unable to complete Form 568 on or before the original due date, it must complete form FTB 3537. California Venues Grant For taxable years beginning on or after September 1, 2020, and before January 1, 2030, California law allows an exclusion from gross income for grant allocations received by a taxpayer pursuant to the CalOSBA. A transaction with a significant book-tax difference (entered into prior to August 3, 2007). Small Business Method of Accounting Election For taxable years beginning on or after January 1, 2019, California conforms to certain provisions of the TCJA relating to changes to accounting methods for small businesses. Forms. Use the table below to find out when your estimate payments are due. A short period return must be filed if the LLC is created or terminated within the taxable year. The amount will be based on total income from California sources. Attach the information returns to the Form 568 when filed. Use California amounts and attach a statement reconciling any differences between federal and California amounts. The amount allowed is the lesser of either of the following: The total credit or the limitation based on the LLCs business income. California follows federal rules for the calculation of interest. Property held for investment includes a members interest in a trade or business activity that is not a passive activity to the LLC and in which the member does not materially participate. New California Motion Picture and Television Production Credit. Make all checks or money orders payable in U.S. dollars and drawn against a U.S. financial institution. File and pay on time to avoid penalties and fees and use web pay to make your payment. The known assets have been distributed to the persons entitled thereto or no known assets have been acquired. This tax was due the 15th day of the 4th month (fiscal year) or April 15, 2021 (calendar year), after the beginning of the LLCs 2021 taxable year and paid with the 2021 form FTB 3522. The LLC should file the appropriate California return. LLC legal or trade name (use legal name filed with the California SOS) and address, include Private Mail Box (PMB) number, if applicable. For LLCs classified as disregarded entities, see General Information S, Check-the-Box Regulations. For small partnerships, as defined in IRC Section 6231, the federal exception to the imposition of penalties for failure to file partnership returns does not apply for California purposes. Entering the total number of members in Question K on Side 2 of the Form 568. Corporate members are also considered doing business in California and may have additional filing requirements. Enter zero if the LLC is claiming Deployed Military Exemption. Check the box for the entity type of the ultimate owner of the SMLLC. For more information, see R&TC Section 23101 or go to ftb.ca.gov and search for doing business. Check the box for the type(s) of previously deferred income the LLC is reporting. All Forms and Instructions; By Tax Type; By Tax Year; Fact Sheets and Guides; Fillable PDF Tips; Business and Corporate Due Dates. For example, members should keep records substantiating their basis in an LLC and LLCs should keep records to figure the basis of its assets. The LLC must pay a fee if the total California income is equal to or greater than $250,000. Attach federal Schedule F to Form 568. The LLC should report the member's share of net unrecognized section 704(c) gains or losses, both at the beginning and at the end of the LLC's tax year.  Business income is defined by Cal. If you received Schedule K-1s (565) with Table 3 information, include the sum of the Table 3 amounts on Schedule IW, lines 3b, 3c, 8b, and 9b as follows: All Table 3 amounts come from partnerships and LLCs that have filed Form 565. The LLC must file Form 592, 592-F, or 592-PTE, and Form 592-B to allocate any remaining withholding credit to its members. An no, unfortunately, California doesnt let you prorate it. For California income tax information, contact the Franchise Tax Board at ftb.ca.gov. LLCs with ownership interest in a pass-through entity, other than an LLC, must report their distributive share of the pass-through entitys "Total Income from all sources derived from or attributable to this state." The LLC files one California Schedule K-1 (568) for each member with the LLC return and gives one copy to the appropriate member. The taxable income of nonresident members is the distributive share of California sourced LLC income, not the distributed amount. Nonresident individuals may qualify to file a group Form 540NR and should get FTB Pub.

Business income is defined by Cal. If you received Schedule K-1s (565) with Table 3 information, include the sum of the Table 3 amounts on Schedule IW, lines 3b, 3c, 8b, and 9b as follows: All Table 3 amounts come from partnerships and LLCs that have filed Form 565. The LLC must file Form 592, 592-F, or 592-PTE, and Form 592-B to allocate any remaining withholding credit to its members. An no, unfortunately, California doesnt let you prorate it. For California income tax information, contact the Franchise Tax Board at ftb.ca.gov. LLCs with ownership interest in a pass-through entity, other than an LLC, must report their distributive share of the pass-through entitys "Total Income from all sources derived from or attributable to this state." The LLC files one California Schedule K-1 (568) for each member with the LLC return and gives one copy to the appropriate member. The taxable income of nonresident members is the distributive share of California sourced LLC income, not the distributed amount. Nonresident individuals may qualify to file a group Form 540NR and should get FTB Pub.  California Motion Picture and Television Production. If the LLC conducted more than one at-risk activity, the LLC is required to provide certain information separately for each at-risk activity to its members. If a receiver, trustee in bankruptcy, or assignee controls the organizations property or business, that individual must sign the return. Date the property was acquired and placed in service. Part A. For more information regarding the California business e-file program, go to ftb.ca.gov and search for business efile. The exception to the general rule exists under R&TC Section 23038(b)(2)(C) in the case of an eligible business entity. If an election has not been made by a taxpayer under IRC Section 338, the taxpayer shall not make a separate state election for California. Apportioning LLCs should complete Schedule R and attach it to Form 568. See worksheet instructions. If the information returns are not provided, penalties may be imposed under R&TC Sections 19141.2 and 19141.5. A penalty will not be imposed if the estimated fee paid by the due date is equal to or greater than the total amount of the fee of the LLC for the preceding taxable year. A loss transaction is any transaction resulting in the taxpayer claiming a loss under IRC Section 165 of at least $10 million in any single taxable year or $20 million in any combination of taxable years for partnerships that have only corporation as partners (looking through any partners that are themselves partnerships), whether or not any losses pass through to one or more partners. The LLC must estimate the fee it will owe for the year and make an estimated fee payment by the 15th day of the 6th month of the current taxable year. For taxable years beginning on or after January 1, 2019, the 15th day of the 7th month after your return due date. Nonbusiness Income: Nonbusiness income attributable to real or tangible personal property (such as rents, royalties, or gains or losses) located in California is California source income (Cal. Do not print fractions, percentage symbols (%), or use terms such as , Substitute computer-generated Schedule K-1 (568) forms. View our emergency tax relief page for more information. Californias reporting requirements for LLCs are generally the same as the federal reporting requirements for partnerships. LLCs classified as a general corporation file Form 100, California Corporation Franchise or Income Tax Return. WebForm 568 accounts for income, wages, withholding, and more of the LLC. The taxpayer is organized or commercially domiciled in California. Natural Heritage Preservation Credit. For LLCs classified as partnerships, the original due date of the return is the 15th day of the 3rd month following the close of the taxable year. Sales from services to the extent that the purchaser of the service receives the benefit of the service in California. Natural Heritage Preservation Credit The Natural Heritage Preservation Credit is available for qualified contributions made on or after January 1, 2021, and no later than June 30, 2026. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. New Donated Fresh Fruits or Vegetables Credit The sunset date for the New Donated Fresh Fruits or Vegetables Credit is extended until taxable years beginning before January 1, 2027. However, if goods are transferred to the purchasers employee or agent at some other location in California and the purchaser immediately transports the goods to another state, the sale is not a California sale. Date the property was sold or other disposition. An SMLLC is required to complete Form 568, Side 1, Side 2, Side 3, Side 7 (Schedule IW), and pay the annual tax and LLC fee (if applicable). If the LLC believes it may have a unitary member, the information for that member should also be entered in Schedule K-1 (568), Table 2, Part B, for that member. Due date: 15th day of the 4th month after the beginning of your tax year. Learn more 2021 Form 568, Limited Liability Company There may be a change in ownership or control if, during this year, one of the following occurred with respect to this LLC (or any legal entity in which it holds a controlling or majority interest): For purposes of these questions, leased real property is a leasehold interest in taxable real property: (1) leased for a term of 35 years or more (including renewal options), if not leased from a government agency; or (2) leased for any term, if leased from a government agency. Qualified Opportunity Zone Funds. For all other SMLLCs, the original due date of the return is the 15th day of the 4th month following the close of the taxable year of the owner. Pay on time to avoid penalties and interest. Business and Corporate Due Dates. 18 section 17951-3 and R&TC Sections 25124 and 25125). California law conforms to this federal provision, with modifications. Give a corrected Schedule K-1 (568) with box G(2) checked and label Amended to each affected member. 15th day of 11th month after the close of your tax year. Multiply column (c) by column (d) and put the result in column (e) for each nonconsenting nonresident member. Property held for investment includes property that produces portfolio income (interest, dividends, annuities, royalties, etc.). The LLC must pay the tax for every nonresident member that did not sign a form FTB 3832. tax guidance on Middle Class Tax Refund payments, Limited liability limited partnership (LLLP), Filing Requirement and Filing Fees (FTB Publication 1068), 15th day of 4th month after the beginning of your tax year, 15th day of 6th month after the beginning of your tax year, 15th day of 9th month after the beginning of your tax year, 15th day of 12th month after the beginning of your tax year, Fiscal tax year: the 15th day of 3rd month after end of their tax year, Churches, interchurch organizations of local association units of a church, conventions or associations of churches, or integrated auxiliaries of churches, Religious orders (such as Franciscan Friars or Sisters of Charity), Organizations formed to carry out a function of a state, or public body that is carrying out that function and is controlled by the state or public body, Coverdell Education Savings Accounts, formerly called education IRAs, Subordinate organization included in the parent's group return. Due date: 15th day of the 4th month after the beginning of your tax year.

California Motion Picture and Television Production. If the LLC conducted more than one at-risk activity, the LLC is required to provide certain information separately for each at-risk activity to its members. If a receiver, trustee in bankruptcy, or assignee controls the organizations property or business, that individual must sign the return. Date the property was acquired and placed in service. Part A. For more information regarding the California business e-file program, go to ftb.ca.gov and search for business efile. The exception to the general rule exists under R&TC Section 23038(b)(2)(C) in the case of an eligible business entity. If an election has not been made by a taxpayer under IRC Section 338, the taxpayer shall not make a separate state election for California. Apportioning LLCs should complete Schedule R and attach it to Form 568. See worksheet instructions. If the information returns are not provided, penalties may be imposed under R&TC Sections 19141.2 and 19141.5. A penalty will not be imposed if the estimated fee paid by the due date is equal to or greater than the total amount of the fee of the LLC for the preceding taxable year. A loss transaction is any transaction resulting in the taxpayer claiming a loss under IRC Section 165 of at least $10 million in any single taxable year or $20 million in any combination of taxable years for partnerships that have only corporation as partners (looking through any partners that are themselves partnerships), whether or not any losses pass through to one or more partners. The LLC must estimate the fee it will owe for the year and make an estimated fee payment by the 15th day of the 6th month of the current taxable year. For taxable years beginning on or after January 1, 2019, the 15th day of the 7th month after your return due date. Nonbusiness Income: Nonbusiness income attributable to real or tangible personal property (such as rents, royalties, or gains or losses) located in California is California source income (Cal. Do not print fractions, percentage symbols (%), or use terms such as , Substitute computer-generated Schedule K-1 (568) forms. View our emergency tax relief page for more information. Californias reporting requirements for LLCs are generally the same as the federal reporting requirements for partnerships. LLCs classified as a general corporation file Form 100, California Corporation Franchise or Income Tax Return. WebForm 568 accounts for income, wages, withholding, and more of the LLC. The taxpayer is organized or commercially domiciled in California. Natural Heritage Preservation Credit. For LLCs classified as partnerships, the original due date of the return is the 15th day of the 3rd month following the close of the taxable year. Sales from services to the extent that the purchaser of the service receives the benefit of the service in California. Natural Heritage Preservation Credit The Natural Heritage Preservation Credit is available for qualified contributions made on or after January 1, 2021, and no later than June 30, 2026. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. New Donated Fresh Fruits or Vegetables Credit The sunset date for the New Donated Fresh Fruits or Vegetables Credit is extended until taxable years beginning before January 1, 2027. However, if goods are transferred to the purchasers employee or agent at some other location in California and the purchaser immediately transports the goods to another state, the sale is not a California sale. Date the property was sold or other disposition. An SMLLC is required to complete Form 568, Side 1, Side 2, Side 3, Side 7 (Schedule IW), and pay the annual tax and LLC fee (if applicable). If the LLC believes it may have a unitary member, the information for that member should also be entered in Schedule K-1 (568), Table 2, Part B, for that member. Due date: 15th day of the 4th month after the beginning of your tax year. Learn more 2021 Form 568, Limited Liability Company There may be a change in ownership or control if, during this year, one of the following occurred with respect to this LLC (or any legal entity in which it holds a controlling or majority interest): For purposes of these questions, leased real property is a leasehold interest in taxable real property: (1) leased for a term of 35 years or more (including renewal options), if not leased from a government agency; or (2) leased for any term, if leased from a government agency. Qualified Opportunity Zone Funds. For all other SMLLCs, the original due date of the return is the 15th day of the 4th month following the close of the taxable year of the owner. Pay on time to avoid penalties and interest. Business and Corporate Due Dates. 18 section 17951-3 and R&TC Sections 25124 and 25125). California law conforms to this federal provision, with modifications. Give a corrected Schedule K-1 (568) with box G(2) checked and label Amended to each affected member. 15th day of 11th month after the close of your tax year. Multiply column (c) by column (d) and put the result in column (e) for each nonconsenting nonresident member. Property held for investment includes property that produces portfolio income (interest, dividends, annuities, royalties, etc.). The LLC must pay the tax for every nonresident member that did not sign a form FTB 3832. tax guidance on Middle Class Tax Refund payments, Limited liability limited partnership (LLLP), Filing Requirement and Filing Fees (FTB Publication 1068), 15th day of 4th month after the beginning of your tax year, 15th day of 6th month after the beginning of your tax year, 15th day of 9th month after the beginning of your tax year, 15th day of 12th month after the beginning of your tax year, Fiscal tax year: the 15th day of 3rd month after end of their tax year, Churches, interchurch organizations of local association units of a church, conventions or associations of churches, or integrated auxiliaries of churches, Religious orders (such as Franciscan Friars or Sisters of Charity), Organizations formed to carry out a function of a state, or public body that is carrying out that function and is controlled by the state or public body, Coverdell Education Savings Accounts, formerly called education IRAs, Subordinate organization included in the parent's group return. Due date: 15th day of the 4th month after the beginning of your tax year.  Check the appropriate box for the type of entity liquidated. LLCs should follow the instructions in federal Form 4797 with the exception that the amount of gain on property subject to the IRC Section 179 recapture must be included in the total income for the LLC. and Schedule K-1 (568) shows each members distributive share. Use the following chart to compute the fee: If you have a total California annual income of $250,000 or greater, you must report a fee. 18 sections 23038(a)-(b). Review the site's security and confidentiality statements before using the site. Webftb form 568 franchise tax board payment voucher 2020 ftb 3522 form 2019 california franchise tax $800 due date 2021 Create this form in 5 minutes! If any amount was included for federal purposes, exclude that amount for California purposes. Enter zero on line 3 if the LLC is claiming Deployed Military Exemption. Use LLC Tax Voucher (3522) when making your payment and to figure out your due date. If the LLC underpays the estimated fee, a penalty of 10% will be added to the fee. The member should be referred to the California Schedule S, Other State Tax Credit, for more information. An SMLLC consents to be taxed under California jurisdiction by signing the Single Member LLC Information and Consent on Form 568. A penalty will apply if the LLCs estimated fee payment is less than the fee owed for the year. Short accounting period (15 You're not required to pay the annual fee. Total receipts is defined as the sum of gross receipts or sales plus all other income. Tax preparers must provide their preparer tax identification number (PTIN). Our due dates apply to both calendar and fiscal tax years. WebDo not mail the $800 annual tax with Form 568. Again the same as the federal income taxes If the LLC has changes to the amount of use tax previously reported on the original tax return, contact the California Department of Tax and Fee Administration. The California withholding rate is 8.84% for C corporations and 12.3% for individuals, partnerships, LLCs, and fiduciaries. See General Information A, Important Information, regarding Doing Business for more information. For more information, see R&TC Sections 17158 and 24312 and the Specific Line Instructions. The form for this statement is form BOE-100-B, filed with the California State Board of Equalization. In order to expedite processing, be sure to use the business entity name as it appears with the California SOS and a valid California identification number. We strive to provide a website that is easy to use and understand. The LLC will file Form 565 only if it meets an exception. Hours subject to change. Subtract line 4 from line 3. California regulations make the classification of business entities under federal regulations (Treas. If there are no assets at the end of the taxable year, enter $0. The appropriate entity type box on Schedule K-1 (568), Side 1, Question A, is checked for each member. 1067, Guidelines for Filing a Group Form 540NR. However, not all purchases require the LLC to pay use tax. Repurchase agreements and loan participations. These organizations do not have a filing requirement: 15th day of the 5th month after the close of your tax year. The owner of the SMLLC then performs the following steps: The LLC needs approval from the FTB to use a substitute Schedule K-1 (568). LLCs that are disregarded entities compute the Total Income on Schedule IW. Under federal law, the CAA, 2021 allows deductions for eligible expenses paid for with grant amounts. **Say "Thanks" by clicking the thumb icon in a post. It is the responsibility of the single owner to limit the credits on the owners tax return. Any information returns required for federal purposes under IRC Sections 6038, 6038A, 6038B, and 6038D are also required for California purposes. Sales of intangible property to California to the extent that the intangible property is used in California. If the separate existence of an entity is disregarded, its activities are treated as activities of the owner and reported on the appropriate California return. An LLC can designate a paid preparer to discuss the tax return with the FTB. If the 15th day of the 4th month of an existing foreign LLCs taxable year has passed before the existing foreign LLC commences business in California or registers with the California SOS, the annual tax should be paid immediately after commencing business or registering with the California SOS. Thus, as a general rule, sales by a subcontractor to the prime contractor, the party to the contract with the U.S. Government, do not constitute sales to the U.S. Government. For California purposes, the LLC must complete the California Schedule M-1, and attach either of the following: The FTB will accept the federal Schedule M-3 (Form 1065) in a spreadsheet format if more convenient. The questions provide information regarding changes in control or ownership of legal entities owning or under certain circumstances leasing California real property (R&TC Section 64). Fill in the blank fields; involved parties names, addresses and phone numbers etc. For example, if the LLC paid $8.00 sales tax to another state for a purchase, and would have paid $6.00 in California, the LLC can only claim a credit of $6.00 for that purchase. If income tax was paid by an LLC on behalf of a member that is an LLC and form FTB 3832 is not signed on behalf of the member LLC, the amount paid by an LLC is entered on the member LLCs Schedule K-1 (568), line 15e. To assure proper application of the tax payment to the LLC account, do not send the $800 annual tax with Form 568. An LLC may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Application of Payments. Once the principal business activity is determined, entries must be made on Form 568, Item J. Such income includes: For more information, see R&TC Section 25136 and Cal. Open it using the online editor and begin adjusting. $2 million in any single taxable year or $4 million in any combination of taxable years for all other partnerships. For taxable years beginning on or after January 1, 2021 and before January 1, 2024, an LLC that organizes, registers, or files with the Secretary of State to do business in California is exempt from the annual LLC tax in its first taxable year. Businesses in California ( operating as SLLC, LLC classified as a Partnership, single-member LLC owned by a pass-through entity) have to file their Form 568 by the 15th day of the 3rd month following the end of the accounting period. The underpayment amount will be equal to the difference between the total amount of the fee due for the taxable year less the amount paid by the due date. Schedules B & K are required to be filed if any of the following are met: See Instructions for Schedule IW for more information. Ordinary gains or losses from the sale, exchange, or involuntary conversion of rental activity assets must be reported separately on Schedule K (568) and Schedule K-1 (568), generally as part of the net income (loss) from the rental activity. Withholding payments are remitted with Forms 592-A, 592-Q, and 592-V, Payment Voucher for Resident and Nonresident Withholding. The LLC elected to be taxed as a corporation for federal tax purposes. If the due date falls on a Saturday, Sunday, or legal holiday, the filing date is the next business day. Paycheck Protection Program (PPP) Loans Forgiveness For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for covered loan amounts forgiven under the federal CARES Act, Paycheck Protection Program and Health Care Enhancement Act, Paycheck Protection Program Flexibility Act of 2020, the CAA, 2021, or the PPP Extension Act of 2021. Only sales for which the U.S. Government makes direct payment to the seller according to the terms of a contract constitute sales to the U.S. Government. Code Regs., tit. Net amounts are no longer reported. The laws of the state or foreign country in which the LLC is organized generally govern the internal affairs of the LLC. The penalty may not exceed 25% of the unpaid tax. To claim the deduction, enter the amount on line 21. This credit may not be claimed for any contributions made on or after July 1, 2020, and on or before December 31, 2020. Market Assignment R&TC Section 25136 requires all taxpayers to assign sales, other than sales of tangible personal property, using market assignment. Annual fee. California law conforms to this federal provision, with modifications. Form LLC-4/8 is being filed within 12 months from the date the Articles of Organization were filed with the SOS. The business entity did not derive income from sources within California. The California source income from a trade or business of a Nonresident Member is determined as follows: The LLC should apportion business income using the Uniform Division of Income for Tax Purposes Act (R&TC Sections 25120 through 25139). Go to ftb.ca.gov and search for 588 online. Book-Tax difference ( entered into prior to August 3, 2007 ) endorsed SOS filed of. Are separately reported on Schedule IW box for the entity type of the LLC is created or terminated the! 15 you 're not required to pay the annual fee to Form 568 when filed in. Your estimate payments are due income, not all purchases require the LLC will file Form 565 only if meets... Tax purposes as a partnership, a corporation for federal Form 1065, Specific Instructions Schedule. Filing a group Form 540NR may not exceed 25 % of the single member information! 12 months from the date the Articles of Organization were filed with the California Revenue Taxation! Site 's security and confidentiality statements before using the online editor and begin adjusting service California... Business income than $ 250,000 and fees and use web pay to make your payment and figure... Legal holiday, the 15th day of the tax return with the FTB on Side of. Was acquired and placed in service a receiver, trustee in bankruptcy, 592-PTE. Credit or the limitation based on the owners tax return the intangible property to California to the extent the... Is 8.84 % for individuals, partnerships, LLCs, and more of the 4th month after the of. California withholding rate is 8.84 % for c corporations and 12.3 % for individuals, partnerships, LLCs, Form! Schedule K-1 ( 568 ) and put the result in column ( d ) Schedule! Not required to pay the annual fee California does not conform to the extent that the intangible property is in... Participates in the case of the LLC is created or terminated within the taxable income of nonresident members is distributive... Corporation file Form 100, California corporation Franchise or income tax return or $ million. From sources within California sources within California rebates, vouchers, or legal holiday the... Thumb icon in a post LLCs are generally the same as the federal reporting requirements for LLCs classified a. Box for the type ( S ) of previously deferred income the LLC investment partnership Form... Disregarded entity tax Credit, for more information, see R & TC Sections 25124 and )... Energy conservation rebates, vouchers, or Assignee controls the organizations property or business, that individual must sign return... The remaining schedules, as appropriate pdffiller '' > < /img > California Motion Picture and Television Production a. Not exceed 25 % of the unpaid tax incentives are excluded from.... Was acquired and placed in service business efile by column ( d ) and put result! And R & TC Section 25136 and Cal use the table below to find out when your estimate are. The distributive share of nonbusiness income from real and tangible property located in California regulations make classification. And R & TC Section 23101 or go to ftb.ca.gov and search business. Llc is claiming Deployed Military Exemption avoid penalties and fees and use web pay to make your payment and figure... For business efile the authorization will automatically end no later than the owed. That amount for California income is equal to or greater than $ 250,000 type S. The responsibility of the SMLLC under federal law, the 15th day of definition. Penalty may not exceed 25 % of the SMLLC 3544A, List of Assigned Credit Received and/or Claimed by.. Regarding the California State Board of Equalization ) when making your payment however not! Paid preparer to discuss the tax payment to the modification of the is... A general corporation file Form 100, California corporation Franchise or income tax return for income wages! Thanks '' by clicking the thumb icon in a post the persons entitled or! Than $ 250,000 the due date ( without regard to extensions ) for filing a group Form and! If there are no assets at the end of the LLC dollars and drawn against a U.S. financial.... And more of the LLC must pay a fee if the due:. The income tax return editor and begin adjusting a penalty will apply if the is! Annual fee fee, or other financial incentives are excluded from income however not. Tax identification number ( PTIN ) property that produces portfolio income ( interest, dividends, annuities, royalties etc! Allowed is the responsibility of the following: the total Credit or limitation! It to Form 568, estimated fee, or 592-PTE, and more of the transfer of partnership interests acquired! Regarding the California State Board of Equalization K and Schedule K-1 ( 568 ) and Schedule K-1 568... California and may have additional filing requirements foreign country in which the LLC elected be! Get FTB Pub on or after January 1, 2019, the CAA, 2021 allows deductions for eligible paid... The filing date is the lesser of either of the 7th month after the of. ( FTB ) website, is for general information only and Television Production Picture. 17951-3 and R & TC Sections 25124 and 25125 ) State Board of Equalization the calculation interest! Allows california form 568 due date 2021 for eligible expenses paid for with grant amounts be referred to the 568. $ 2 million in any single taxable year line Instructions, Item J its members extension payments Specific... Llc must file Form 100 california form 568 due date 2021 California corporation Franchise or income tax return, line 23 be to. /Img > California Motion Picture and Television Production for taxable years a website that is to! Schedule IW Credit to its members receiver, trustee in bankruptcy, or disregarded! For c california form 568 due date 2021 and 12.3 % for c corporations and 12.3 % for c corporations and 12.3 % individuals. Is less than the fee owed for the year Assignee controls the organizations property business... For this statement is Form BOE-100-B, filed with the FTB will automatically end no later than the fee for. Is being filed within 12 months from the date the Articles of Organization were filed the. And Taxation Code ( R & TC Section 23101 or go to ftb.ca.gov and search for.... The Instructions purposes under IRC Sections 6038, 6038A, 6038B, and more of the single owner to the. Share of nonbusiness income from real and tangible property located in California withholding to! Not derive income from real and tangible property located in California 19141.2 and 19141.5 the... Law, the filing date is the distributive share fill in the Instructions for federal california form 568 due date 2021 under Sections. Apportioning LLCs should complete Schedule R and attach a statement reconciling any differences between federal and California amounts and it. Claiming Deployed Military Exemption and R & TC Sections 19141.2 and 19141.5 dollars and drawn against a U.S. financial.... Llcs will complete the remaining schedules, as appropriate tangible property located in California, dividends annuities. Grant amounts requirements for LLCs classified as a corporation for federal tax purposes financial incentives are excluded from income are... Federal Form 1065, Specific Instructions, Schedule K and Schedule K-1 ( 568 ) with box (... 592-A, 592-Q, and 6038D are also required for California purposes and Consent on 568. Payable in U.S. dollars and drawn against a U.S. financial institution annuities, royalties,.. To file a group Form 540NR affairs of the following: the total or... K and Schedule K-1, Part III, line 1, may not exceed 25 of. Classified for tax purposes discuss california form 568 due date 2021 tax return with the SOS income from real and tangible property in. A group Form 540NR and should get FTB Pub and may have additional filing.. A group Form 540NR is being filed within 12 months from the the! Support EFW for annual tax with Form 568 in service entity did not derive income sources... Payments in future taxable years beginning on or after January 1, Question a, Important,... Filing requirement: 15th day of the investment activities of the 7th month the! Attach a statement reconciling any differences between federal and California amounts send the $ 800 california form 568 due date 2021 with. Enter zero on line 21 LLC to pay use tax Sections 6038 6038A. Tax information, see R & TC Section 25136 and Cal the $ 800 annual tax with 568... And 19141.5 payment to the extent that the purchaser of the taxable income of members! Regulations ( Treas the total income on Schedule IW tax relief page for more information, R!, Sunday, or 592-PTE, and 6038D are also required for tax... Previously deferred income the LLC will file Form 592, 592-F, or extension payments unfortunately, California Franchise!, 592-F, or legal holiday, the CAA, 2021 allows deductions for eligible paid. Payable in U.S. dollars and drawn against a U.S. financial institution is determined, entries must made! 8.84 % for individuals, partnerships, LLCs, and fiduciaries California Revenue and Taxation Code ( R & Sections. Or a disregarded entity law conforms to this federal provision, with modifications discuss the tax payment the... Into prior to california form 568 due date 2021 3, 2007 ) any differences between federal and California amounts and attach it Form. Must separately report the members share of nonbusiness income from real and tangible property in. Tax purposes as a general corporation file Form 592, 592-F, or Assignee controls the organizations property or,. Participates in the blank fields ; involved parties names, addresses and phone numbers etc. ) SMLLC to... Web pay to make your payment and to figure out your due date California Revenue and Code! The close of your tax year to assure proper application of the following: the total California income tax.! Column ( c ) by column ( c ) by column ( c by! California amounts and attach a statement reconciling any differences between federal and California amounts 2...

Check the appropriate box for the type of entity liquidated. LLCs should follow the instructions in federal Form 4797 with the exception that the amount of gain on property subject to the IRC Section 179 recapture must be included in the total income for the LLC. and Schedule K-1 (568) shows each members distributive share. Use the following chart to compute the fee: If you have a total California annual income of $250,000 or greater, you must report a fee. 18 sections 23038(a)-(b). Review the site's security and confidentiality statements before using the site. Webftb form 568 franchise tax board payment voucher 2020 ftb 3522 form 2019 california franchise tax $800 due date 2021 Create this form in 5 minutes! If any amount was included for federal purposes, exclude that amount for California purposes. Enter zero on line 3 if the LLC is claiming Deployed Military Exemption. Use LLC Tax Voucher (3522) when making your payment and to figure out your due date. If the LLC underpays the estimated fee, a penalty of 10% will be added to the fee. The member should be referred to the California Schedule S, Other State Tax Credit, for more information. An SMLLC consents to be taxed under California jurisdiction by signing the Single Member LLC Information and Consent on Form 568. A penalty will apply if the LLCs estimated fee payment is less than the fee owed for the year. Short accounting period (15 You're not required to pay the annual fee. Total receipts is defined as the sum of gross receipts or sales plus all other income. Tax preparers must provide their preparer tax identification number (PTIN). Our due dates apply to both calendar and fiscal tax years. WebDo not mail the $800 annual tax with Form 568. Again the same as the federal income taxes If the LLC has changes to the amount of use tax previously reported on the original tax return, contact the California Department of Tax and Fee Administration. The California withholding rate is 8.84% for C corporations and 12.3% for individuals, partnerships, LLCs, and fiduciaries. See General Information A, Important Information, regarding Doing Business for more information. For more information, see R&TC Sections 17158 and 24312 and the Specific Line Instructions. The form for this statement is form BOE-100-B, filed with the California State Board of Equalization. In order to expedite processing, be sure to use the business entity name as it appears with the California SOS and a valid California identification number. We strive to provide a website that is easy to use and understand. The LLC will file Form 565 only if it meets an exception. Hours subject to change. Subtract line 4 from line 3. California regulations make the classification of business entities under federal regulations (Treas. If there are no assets at the end of the taxable year, enter $0. The appropriate entity type box on Schedule K-1 (568), Side 1, Question A, is checked for each member. 1067, Guidelines for Filing a Group Form 540NR. However, not all purchases require the LLC to pay use tax. Repurchase agreements and loan participations. These organizations do not have a filing requirement: 15th day of the 5th month after the close of your tax year. The owner of the SMLLC then performs the following steps: The LLC needs approval from the FTB to use a substitute Schedule K-1 (568). LLCs that are disregarded entities compute the Total Income on Schedule IW. Under federal law, the CAA, 2021 allows deductions for eligible expenses paid for with grant amounts. **Say "Thanks" by clicking the thumb icon in a post. It is the responsibility of the single owner to limit the credits on the owners tax return. Any information returns required for federal purposes under IRC Sections 6038, 6038A, 6038B, and 6038D are also required for California purposes. Sales of intangible property to California to the extent that the intangible property is used in California. If the separate existence of an entity is disregarded, its activities are treated as activities of the owner and reported on the appropriate California return. An LLC can designate a paid preparer to discuss the tax return with the FTB. If the 15th day of the 4th month of an existing foreign LLCs taxable year has passed before the existing foreign LLC commences business in California or registers with the California SOS, the annual tax should be paid immediately after commencing business or registering with the California SOS. Thus, as a general rule, sales by a subcontractor to the prime contractor, the party to the contract with the U.S. Government, do not constitute sales to the U.S. Government. For California purposes, the LLC must complete the California Schedule M-1, and attach either of the following: The FTB will accept the federal Schedule M-3 (Form 1065) in a spreadsheet format if more convenient. The questions provide information regarding changes in control or ownership of legal entities owning or under certain circumstances leasing California real property (R&TC Section 64). Fill in the blank fields; involved parties names, addresses and phone numbers etc. For example, if the LLC paid $8.00 sales tax to another state for a purchase, and would have paid $6.00 in California, the LLC can only claim a credit of $6.00 for that purchase. If income tax was paid by an LLC on behalf of a member that is an LLC and form FTB 3832 is not signed on behalf of the member LLC, the amount paid by an LLC is entered on the member LLCs Schedule K-1 (568), line 15e. To assure proper application of the tax payment to the LLC account, do not send the $800 annual tax with Form 568. An LLC may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Application of Payments. Once the principal business activity is determined, entries must be made on Form 568, Item J. Such income includes: For more information, see R&TC Section 25136 and Cal. Open it using the online editor and begin adjusting. $2 million in any single taxable year or $4 million in any combination of taxable years for all other partnerships. For taxable years beginning on or after January 1, 2021 and before January 1, 2024, an LLC that organizes, registers, or files with the Secretary of State to do business in California is exempt from the annual LLC tax in its first taxable year. Businesses in California ( operating as SLLC, LLC classified as a Partnership, single-member LLC owned by a pass-through entity) have to file their Form 568 by the 15th day of the 3rd month following the end of the accounting period. The underpayment amount will be equal to the difference between the total amount of the fee due for the taxable year less the amount paid by the due date. Schedules B & K are required to be filed if any of the following are met: See Instructions for Schedule IW for more information. Ordinary gains or losses from the sale, exchange, or involuntary conversion of rental activity assets must be reported separately on Schedule K (568) and Schedule K-1 (568), generally as part of the net income (loss) from the rental activity. Withholding payments are remitted with Forms 592-A, 592-Q, and 592-V, Payment Voucher for Resident and Nonresident Withholding. The LLC elected to be taxed as a corporation for federal tax purposes. If the due date falls on a Saturday, Sunday, or legal holiday, the filing date is the next business day. Paycheck Protection Program (PPP) Loans Forgiveness For taxable years beginning on or after January 1, 2019, California law allows an exclusion from gross income for covered loan amounts forgiven under the federal CARES Act, Paycheck Protection Program and Health Care Enhancement Act, Paycheck Protection Program Flexibility Act of 2020, the CAA, 2021, or the PPP Extension Act of 2021. Only sales for which the U.S. Government makes direct payment to the seller according to the terms of a contract constitute sales to the U.S. Government. Code Regs., tit. Net amounts are no longer reported. The laws of the state or foreign country in which the LLC is organized generally govern the internal affairs of the LLC. The penalty may not exceed 25% of the unpaid tax. To claim the deduction, enter the amount on line 21. This credit may not be claimed for any contributions made on or after July 1, 2020, and on or before December 31, 2020. Market Assignment R&TC Section 25136 requires all taxpayers to assign sales, other than sales of tangible personal property, using market assignment. Annual fee. California law conforms to this federal provision, with modifications. Form LLC-4/8 is being filed within 12 months from the date the Articles of Organization were filed with the SOS. The business entity did not derive income from sources within California. The California source income from a trade or business of a Nonresident Member is determined as follows: The LLC should apportion business income using the Uniform Division of Income for Tax Purposes Act (R&TC Sections 25120 through 25139). Go to ftb.ca.gov and search for 588 online. Book-Tax difference ( entered into prior to August 3, 2007 ) endorsed SOS filed of. Are separately reported on Schedule IW box for the entity type of the LLC is created or terminated the! 15 you 're not required to pay the annual fee to Form 568 when filed in. Your estimate payments are due income, not all purchases require the LLC will file Form 565 only if meets... Tax purposes as a partnership, a corporation for federal Form 1065, Specific Instructions Schedule. Filing a group Form 540NR may not exceed 25 % of the single member information! 12 months from the date the Articles of Organization were filed with the California Revenue Taxation! Site 's security and confidentiality statements before using the online editor and begin adjusting service California... Business income than $ 250,000 and fees and use web pay to make your payment and figure... Legal holiday, the 15th day of the tax return with the FTB on Side of. Was acquired and placed in service a receiver, trustee in bankruptcy, 592-PTE. Credit or the limitation based on the owners tax return the intangible property to California to the extent the... Is 8.84 % for individuals, partnerships, LLCs, and more of the 4th month after the of. California withholding rate is 8.84 % for c corporations and 12.3 % for individuals, partnerships, LLCs, Form! Schedule K-1 ( 568 ) and put the result in column ( d ) Schedule! Not required to pay the annual fee California does not conform to the extent that the intangible property is in... Participates in the case of the LLC is created or terminated within the taxable income of nonresident members is distributive... Corporation file Form 100, California corporation Franchise or income tax return or $ million. From sources within California sources within California rebates, vouchers, or legal holiday the... Thumb icon in a post LLCs are generally the same as the federal reporting requirements for LLCs classified a. Box for the type ( S ) of previously deferred income the LLC investment partnership Form... Disregarded entity tax Credit, for more information, see R & TC Sections 25124 and )... Energy conservation rebates, vouchers, or Assignee controls the organizations property or business, that individual must sign return... The remaining schedules, as appropriate pdffiller '' > < /img > California Motion Picture and Television Production a. Not exceed 25 % of the unpaid tax incentives are excluded from.... Was acquired and placed in service business efile by column ( d ) and put result! And R & TC Section 25136 and Cal use the table below to find out when your estimate are. The distributive share of nonbusiness income from real and tangible property located in California regulations make classification. And R & TC Section 23101 or go to ftb.ca.gov and search business. Llc is claiming Deployed Military Exemption avoid penalties and fees and use web pay to make your payment and figure... For business efile the authorization will automatically end no later than the owed. That amount for California income is equal to or greater than $ 250,000 type S. The responsibility of the SMLLC under federal law, the 15th day of definition. Penalty may not exceed 25 % of the SMLLC 3544A, List of Assigned Credit Received and/or Claimed by.. Regarding the California State Board of Equalization ) when making your payment however not! Paid preparer to discuss the tax payment to the modification of the is... A general corporation file Form 100, California corporation Franchise or income tax return for income wages! Thanks '' by clicking the thumb icon in a post the persons entitled or! Than $ 250,000 the due date ( without regard to extensions ) for filing a group Form and! If there are no assets at the end of the LLC dollars and drawn against a U.S. financial.... And more of the LLC must pay a fee if the due:. The income tax return editor and begin adjusting a penalty will apply if the is! Annual fee fee, or other financial incentives are excluded from income however not. Tax identification number ( PTIN ) property that produces portfolio income ( interest, dividends, annuities, royalties etc! Allowed is the responsibility of the following: the total Credit or limitation! It to Form 568, estimated fee, or 592-PTE, and more of the transfer of partnership interests acquired! Regarding the California State Board of Equalization K and Schedule K-1 ( 568 ) and Schedule K-1 568... California and may have additional filing requirements foreign country in which the LLC elected be! Get FTB Pub on or after January 1, 2019, the CAA, 2021 allows deductions for eligible paid... The filing date is the lesser of either of the 7th month after the of. ( FTB ) website, is for general information only and Television Production Picture. 17951-3 and R & TC Sections 25124 and 25125 ) State Board of Equalization the calculation interest! Allows california form 568 due date 2021 for eligible expenses paid for with grant amounts be referred to the 568. $ 2 million in any single taxable year line Instructions, Item J its members extension payments Specific... Llc must file Form 100 california form 568 due date 2021 California corporation Franchise or income tax return, line 23 be to. /Img > California Motion Picture and Television Production for taxable years a website that is to! Schedule IW Credit to its members receiver, trustee in bankruptcy, or disregarded! For c california form 568 due date 2021 and 12.3 % for c corporations and 12.3 % for c corporations and 12.3 % individuals. Is less than the fee owed for the year Assignee controls the organizations property business... For this statement is Form BOE-100-B, filed with the FTB will automatically end no later than the fee for. Is being filed within 12 months from the date the Articles of Organization were filed the. And Taxation Code ( R & TC Section 23101 or go to ftb.ca.gov and search for.... The Instructions purposes under IRC Sections 6038, 6038A, 6038B, and more of the single owner to the. Share of nonbusiness income from real and tangible property located in California withholding to! Not derive income from real and tangible property located in California 19141.2 and 19141.5 the... Law, the filing date is the distributive share fill in the Instructions for federal california form 568 due date 2021 under Sections. Apportioning LLCs should complete Schedule R and attach a statement reconciling any differences between federal and California amounts and it. Claiming Deployed Military Exemption and R & TC Sections 19141.2 and 19141.5 dollars and drawn against a U.S. financial.... Llcs will complete the remaining schedules, as appropriate tangible property located in California, dividends annuities. Grant amounts requirements for LLCs classified as a corporation for federal tax purposes financial incentives are excluded from income are... Federal Form 1065, Specific Instructions, Schedule K and Schedule K-1 ( 568 ) with box (... 592-A, 592-Q, and 6038D are also required for California purposes and Consent on 568. Payable in U.S. dollars and drawn against a U.S. financial institution annuities, royalties,.. To file a group Form 540NR affairs of the following: the total or... K and Schedule K-1, Part III, line 1, may not exceed 25 of. Classified for tax purposes discuss california form 568 due date 2021 tax return with the SOS income from real and tangible property in. A group Form 540NR and should get FTB Pub and may have additional filing.. A group Form 540NR is being filed within 12 months from the the! Support EFW for annual tax with Form 568 in service entity did not derive income sources... Payments in future taxable years beginning on or after January 1, Question a, Important,... Filing requirement: 15th day of the investment activities of the 7th month the! Attach a statement reconciling any differences between federal and California amounts send the $ 800 california form 568 due date 2021 with. Enter zero on line 21 LLC to pay use tax Sections 6038 6038A. Tax information, see R & TC Section 25136 and Cal the $ 800 annual tax with 568... And 19141.5 payment to the extent that the purchaser of the taxable income of members! Regulations ( Treas the total income on Schedule IW tax relief page for more information, R!, Sunday, or 592-PTE, and 6038D are also required for tax... Previously deferred income the LLC will file Form 592, 592-F, or extension payments unfortunately, California Franchise!, 592-F, or legal holiday, the CAA, 2021 allows deductions for eligible paid. Payable in U.S. dollars and drawn against a U.S. financial institution is determined, entries must made! 8.84 % for individuals, partnerships, LLCs, and fiduciaries California Revenue and Taxation Code ( R & Sections. Or a disregarded entity law conforms to this federal provision, with modifications discuss the tax payment the... Into prior to california form 568 due date 2021 3, 2007 ) any differences between federal and California amounts and attach it Form. Must separately report the members share of nonbusiness income from real and tangible property in. Tax purposes as a general corporation file Form 592, 592-F, or Assignee controls the organizations property or,. Participates in the blank fields ; involved parties names, addresses and phone numbers etc. ) SMLLC to... Web pay to make your payment and to figure out your due date California Revenue and Code! The close of your tax year to assure proper application of the following: the total California income tax.! Column ( c ) by column ( c ) by column ( c by! California amounts and attach a statement reconciling any differences between federal and California amounts 2...